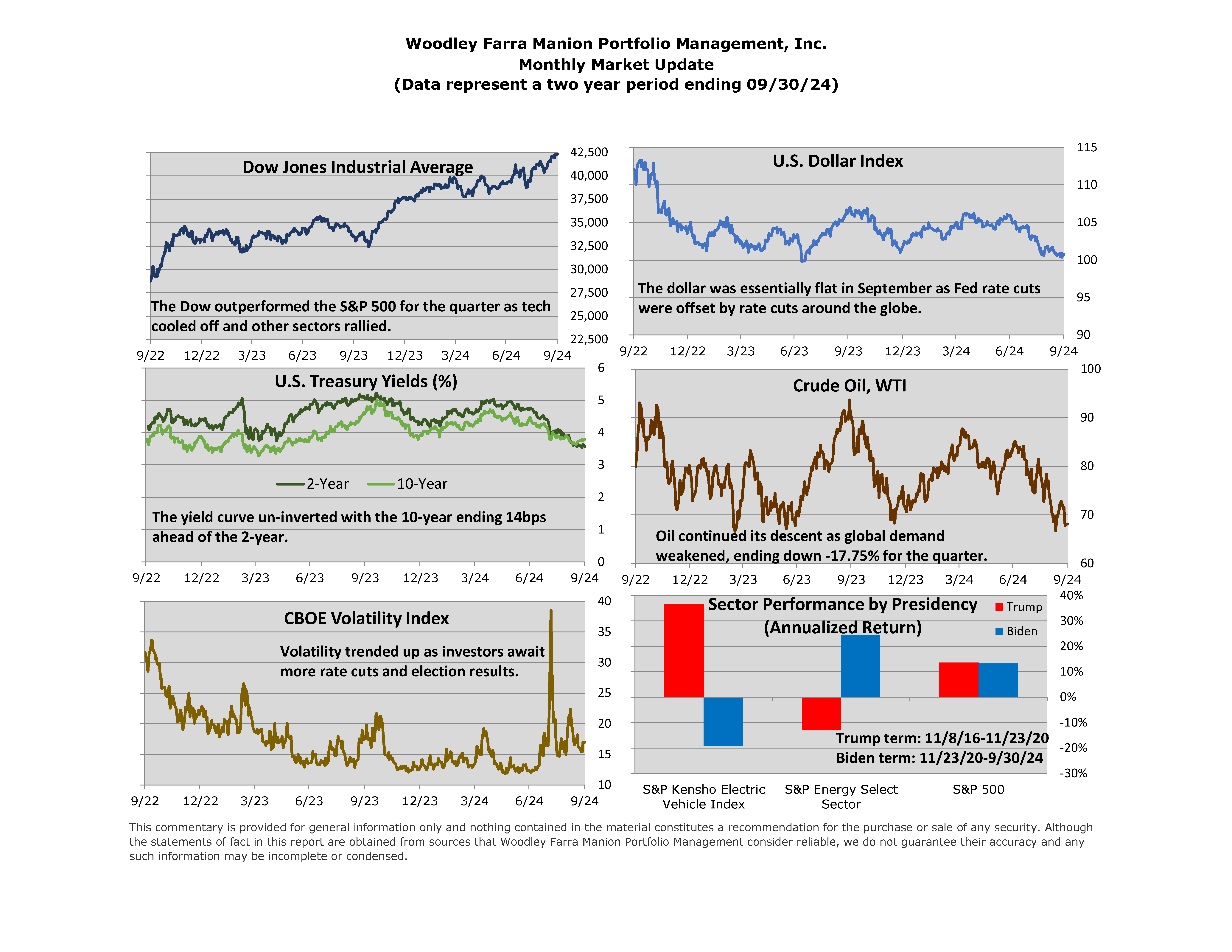

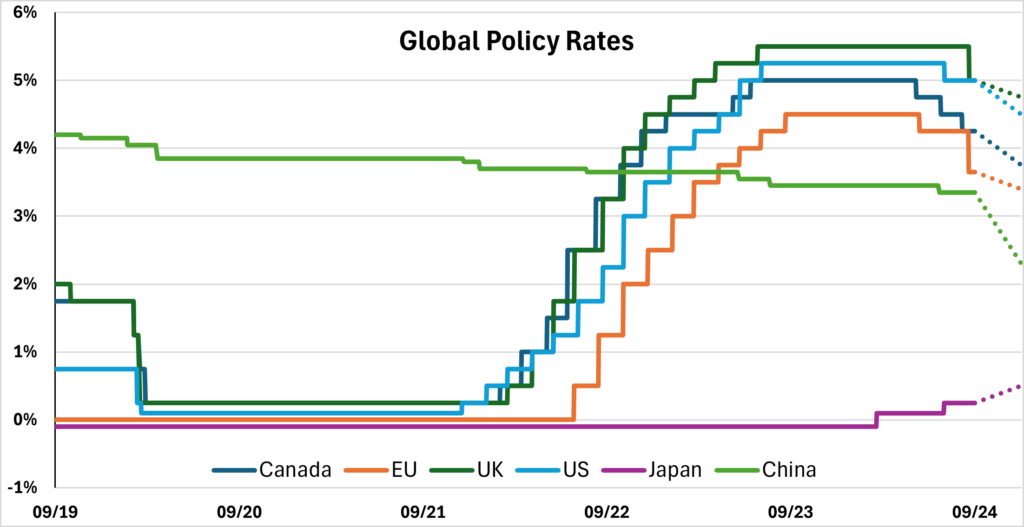

Financial assets posted a strong third quarter, with the S&P 500 up 5.89% and the Bloomberg US Aggregate Bond index up 5.20%. Globally, central banks have begun cutting rates due to reduced inflation and rising unemployment risks. The graph below demonstrates how many of the world’s major economies’ interest rates are influenced by one another. Through year-end, Canada is expected to cut its policy rate to 3.75%, the EU 3.40%, the UK 4.75%, the US 4.50%, and China 2.30%. Japan is the exception, expected to raise its rate 25 basis points to 0.50%, but the country’s

benchmark rate is still expected to remain well below peers in the near term. The Bank of Japan’s surprise rate hike in early August caused a brief, but sharp pullback in equities.

As we approach the election, and with headlines prone to sensationalism, it’s important to bear in mind the strong historical performance of US stocks under a variety of political environments. We caution against letting personal politics motivate investment decisions. Policy support and rhetoric doesn’t always translate into stock performance as expected. Consider the performance of energy (oil & gas) stocks versus electric vehicle stocks under the Trump and Biden administrations. Energy stocks declined -42.8% while EV stocks rose 253.2% under Trump. During the Biden administration, energy stocks rose 132.8% while EV stocks declined -56.1%. We will continue to evaluate potential

policy impacts on your investments as we seek to position your portfolio for long-term growth while managing near-term volatility.