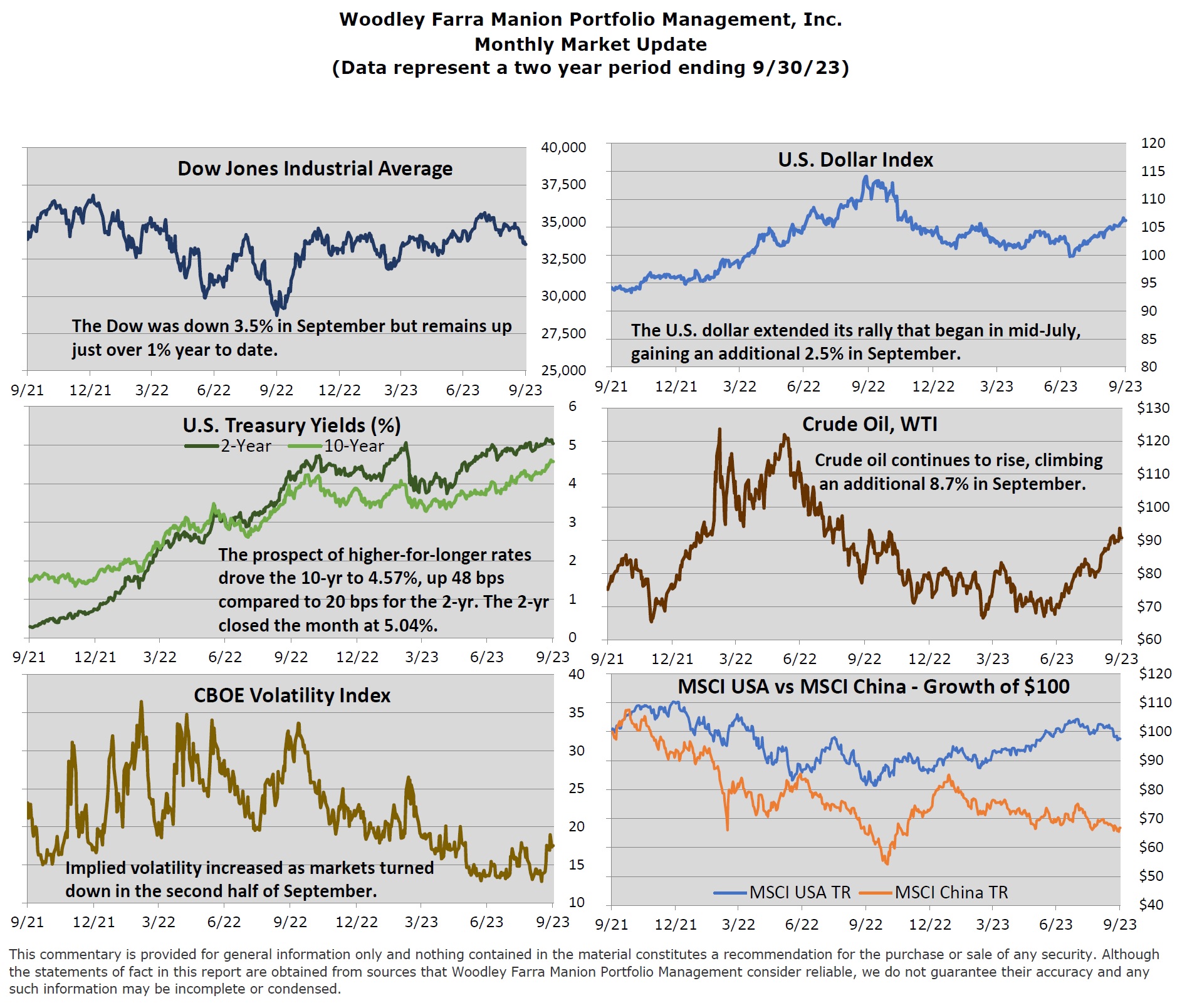

September brought a notable shift in the markets, with the S&P 500 index experiencing a 5% decline. Bonds did not fare much better, as the U.S. Aggregate Bond index fell 3%. This decline was due to the continued increase in longer-term interest rates. The U.S. 10-year treasury yield reached 4.6%, while the 30-year fixed-rate mortgage climbed to 7.3%, both 15-year highs. The persistence of elevated interest rates has caught many investors off guard. For much of the past couple of years, consensus has been that interest rates would soon revert to lower levels, but the reality of “higher-for-longer” rates is taking hold. While we refrain from making rate predictions, we diligently assess the risks associated with rising yields. Heavily indebted companies, banks, unprofitable stocks, and those with extreme valuations are most at risk.

China has emerged as a unique risk to U.S. markets. Reflecting on history, one might have expected significant returns from Chinese investments, given the country’s remarkable economic growth over the past three decades. China’s real GDP per capita grew at 5x the U.S rate since 1993. However, $1 invested in the Chinese stock market (MSCI China Index) on 9/30/1993 would be worth $1.33 today, while $1 invested in the U.S. stock market (MSCI USA Index) would be $16.96 (assumes dividend reinvestment). Economic growth does not equal investment returns. Sound economic and fiscal policies matter. China’s current leadership has adopted a more authoritarian approach to the economy. Markets that favor the free flow and formation of capital (i.e., capitalism) usually work out well for investors in the long run. Today, China’s challenges include a deflating real estate bubble, rising geopolitical tensions, reduced foreign investment, and softening exports. Despite the U.S. stock market’s complacency regarding China risks, we remain vigilant and selective in our approach, carefully avoiding excessive exposure to China in individual stocks and portfolios. We feel confident in saying our clients’ stock portfolios hold lower China exposure than that of the S&P 500. It is difficult to fully capture China risk in a single number, especially from the level of the overall stock market. Exposure can come in the form of revenue, assets, suppliers, and more. According to FactSet, the S&P 500 derives 7.5% of revenue from China, while the Core Value and Dividend composite portfolios derive less than 5.5% and 4%, respectively.

The S&P 500 has retreated 6.6% from its July peak. While such pullbacks may appear concerning, long-term investors should note they are common occurrences. The average intra-year drop since 1980 is 14.3%. The recent pullback has created more favorable prices and valuations compared to just a few months ago. The U.S. economy remains resilient, and inflation has trended down. These factors, combined with ongoing strength in corporate earnings, may be sufficient for the markets to overcome the challenges posed by rising interest rates and China-related risks.

-Jared J. Ruxer, CFA, MS