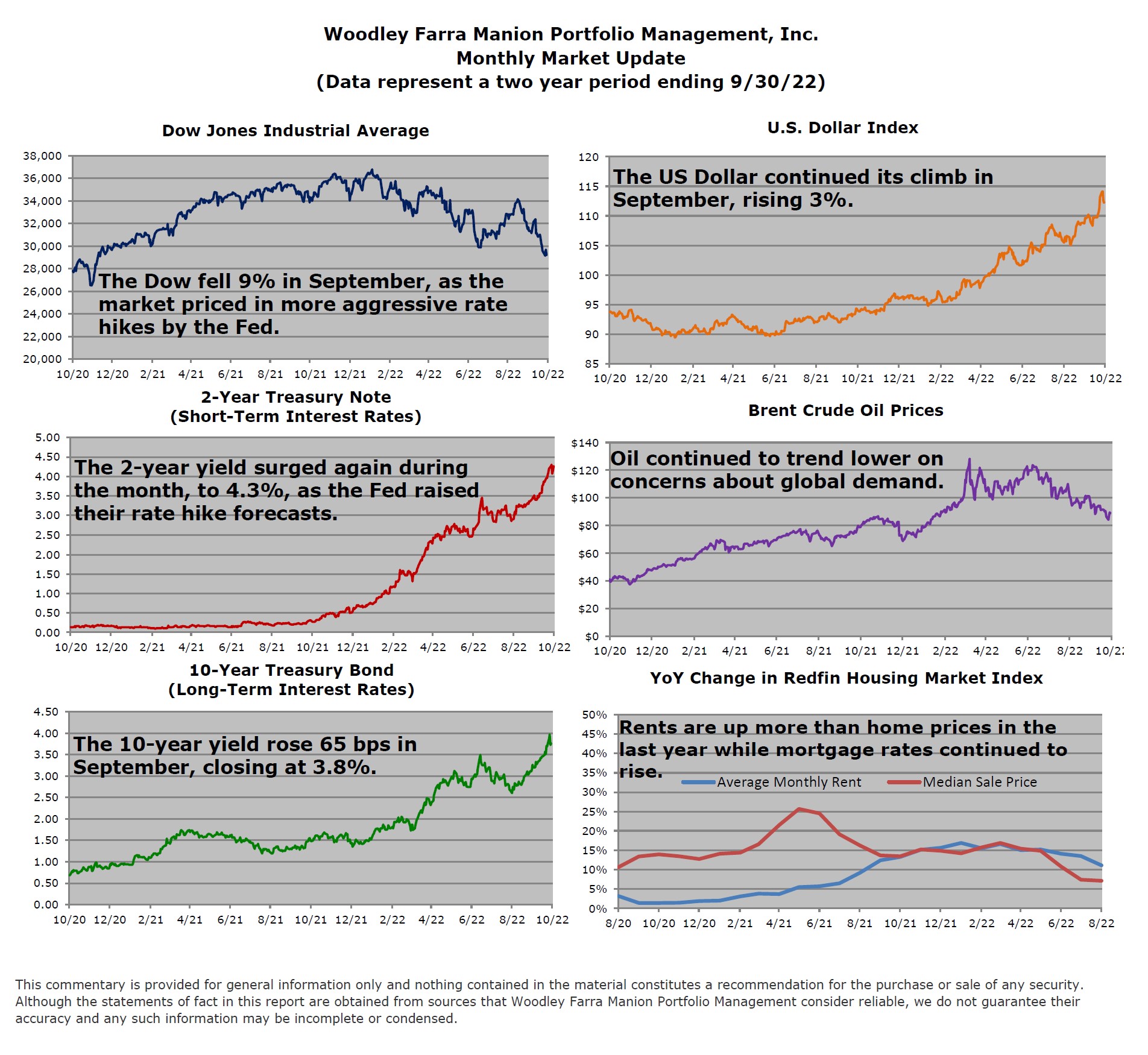

The stock market had a significant rally in the first half of the third quarter, followed by another leg down in late August & September that took the major indices back to mid-June lows. Hawkish comments by the Fed regarding inflation pressures caused treasury interest rates to reach 12-year highs.

Despite the pain higher interest rates have caused, the Fed’s actions have begun to show progress in slowing inflation. A by-product of the Fed’s policies is that the US dollar is at multi-year highs. This has attracted global capital to the US, reduced the price of imports, and put downward pressure to commodity prices. The tight US labor market has somewhat offset these benefits, and the Fed has stated that labor markets need to weaken to reduce inflation.

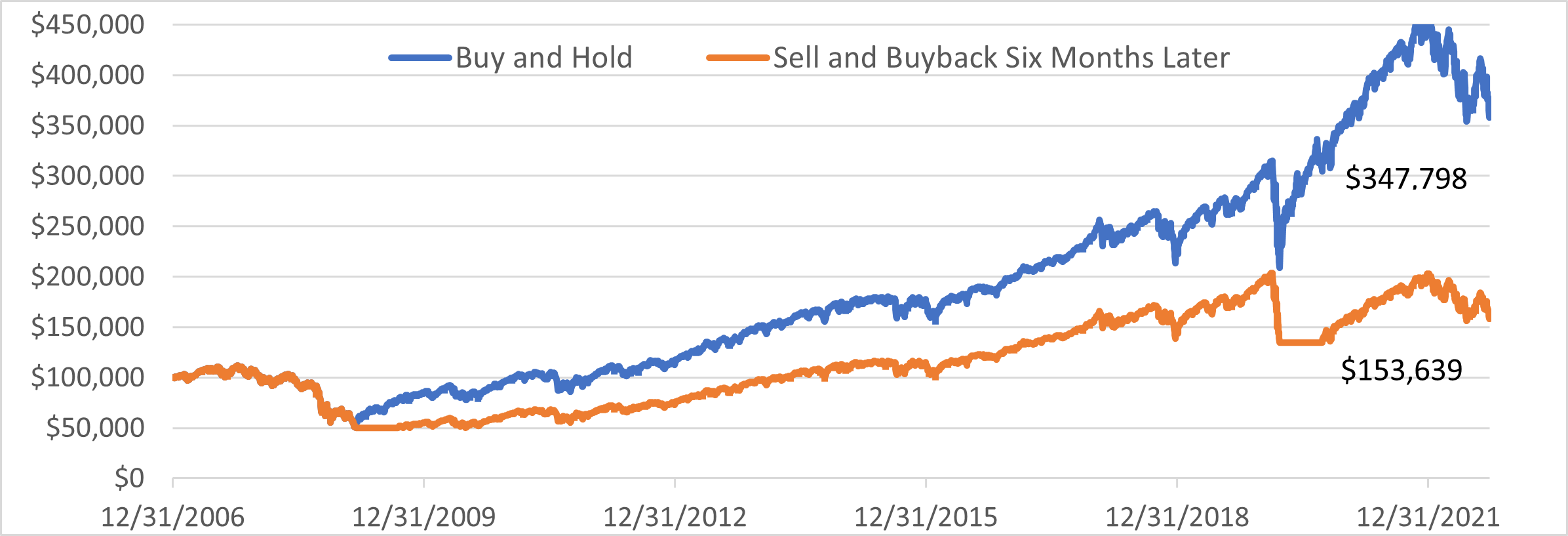

No one can predict when the stock market will finally bottom and reverse higher. Bear markets tend to be short and sharp or long, drawn-out affairs; this decline qualifies as the latter. Markets find a bottom when valuations are too attractive for buyers to pass up. We do believe the bulk of this decline has occurred. Cash on hand should be deployed systematically into stocks with strong fundamentals, seasoned management, and attractive valuations. History shows that market timing is a fool’s errand that carries significant risks. One of the most destructive decisions an investor can make is riding the market down, selling that locks in losses, and failing to get back in during the recovery. The 15-year chart below compares a buy and hold investment in the S&P 500 (blue, 12.2% annualized total return) to an investor who sold at the lows of the Great Financial Crisis and the COVID pandemic (orange, 4.0% annualized total return). This pattern has been repeated following every bear market since 1929.

– George S. Farra, CFA