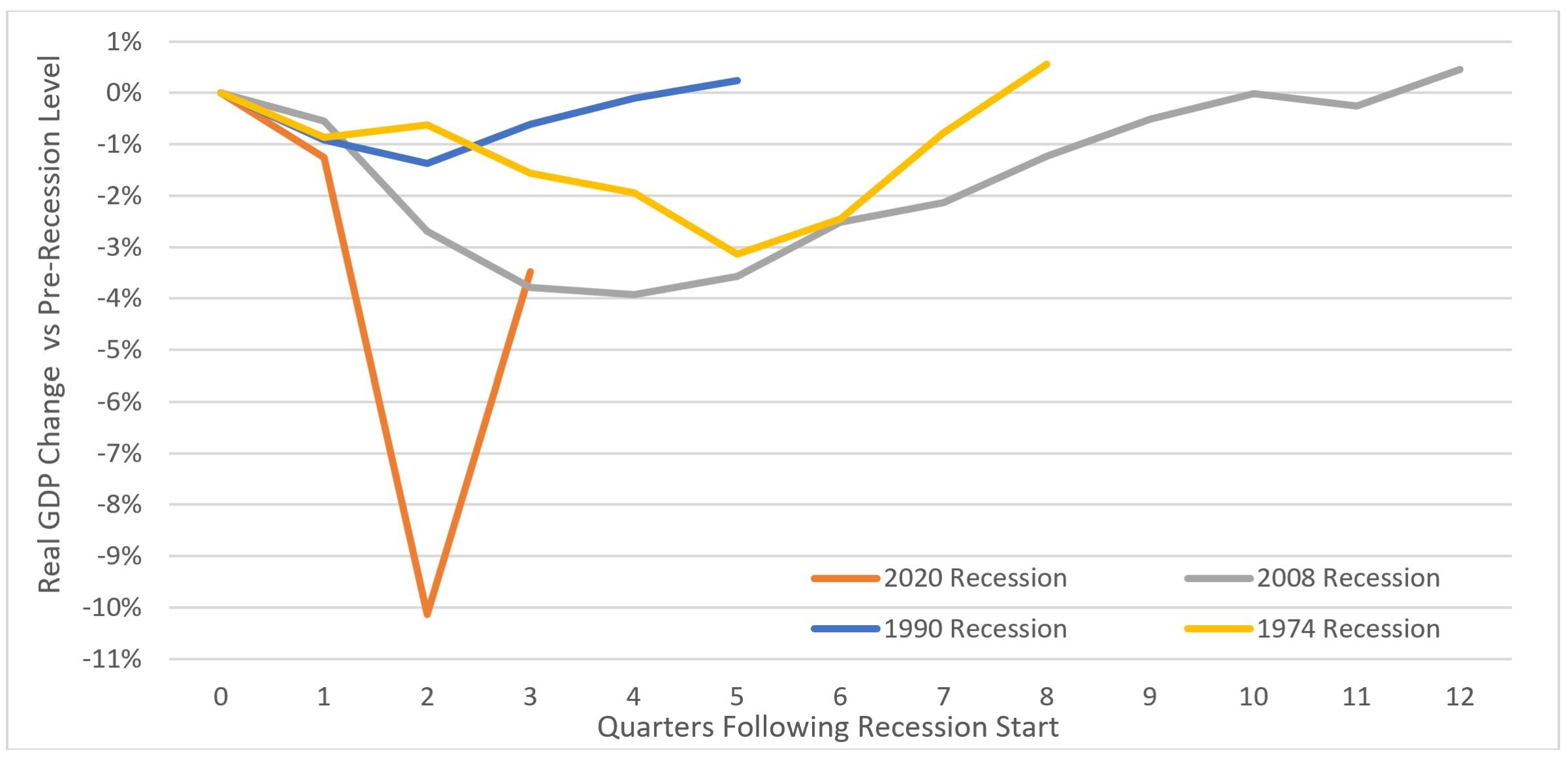

The U.S. Bureau of Economic Analysis released third quarter Gross Domestic Product (GDP) results on October 29th, showing the economy staged a strong rebound. In the third quarter, GDP rose at a seasonally adjusted annual rate of 33.1%, following the second quarter decline of 31.4%. Annual conversions of quarterly figures magnify changes. The below chart shows US GDP relative to its pre-recession level (Quarter 0). It illustrates the uniqueness of the current recession – which will hopefully prove to be deep, but relatively brief. While there is still progress to be made, the US economy has come a long way since the spring. The speed of the recovery has exceeded many economists’ expectations. In June, the Federal Reserve Bank released their first post-pandemic projections, calling for year-end 2020 unemployment of 9.3% and the US economy (GDP) to be 6.5% smaller than it was in the fourth quarter of 2019. As of September, the unemployment rate stood at 7.8% and third quarter GDP was 3.5% below fourth quarter 2019 levels. As government stimulus tapered off in Q3, private sector wages & salaries rebounded. Consumers showed a willingness to spend again, following record saving in Q2.

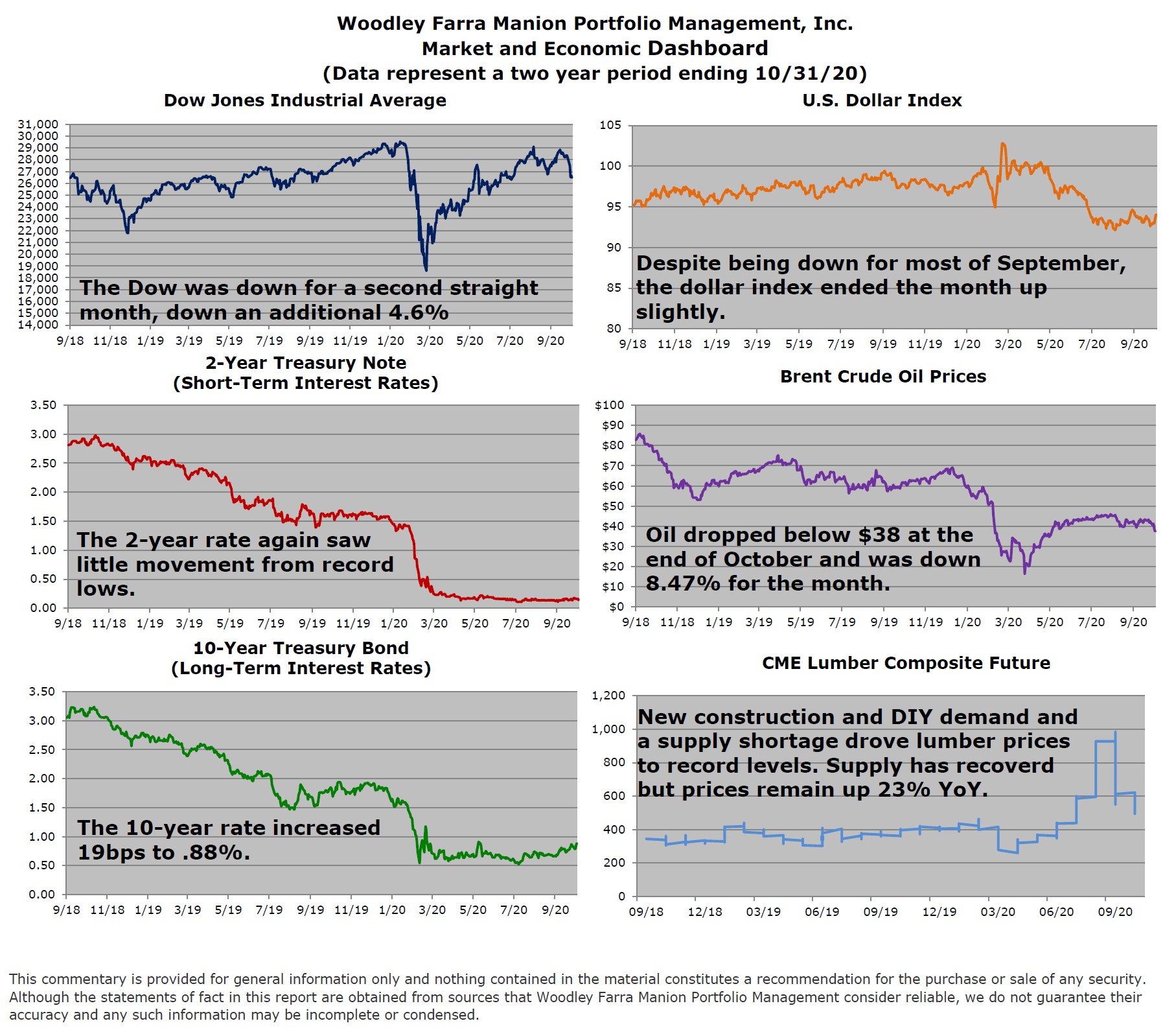

Despite the positive economic data, the S&P 500 declined 2.8% in October as COVID-19 cases surged in Europe and the US. Concerns over the potential for renewed lockdowns mounted as the month passed, with the S&P 500 declining 5.6% in the final week. While the latest surge in cases is undoubtedly a negative, the US and global health systems possess more tools and knowledge to aid in the fight against COVID-19 than in the spring. On October 22nd Veklury (Remdesivir) became the first FDA approved COVID-19 treatment, and Regeneron’s antibody cocktail is being reviewed for Emergency Use Authorization by the FDA following positive clinical-trial data released October 28th. While these are far from cures, they have demonstrated an ability to improve patient outcomes. Several vaccine studies are likely to conclude in the coming weeks and testing has become more widely available with faster results.

It would be impossible not to address the election while discussing the current state of markets. A few key points: 1) No one knows for sure what the outcome will be. 2) Mixing political opinion with financial decision-making is unlikely to produce good results in the long run. 3) The US economy and stock market historical track records are outstanding regardless of the party in the White House or Congress.

-Jared J. Ruxer, MS