Like most Americans we are grateful the election will be over on November 8. That said, we continue to maintain that history is the best resource as to the stock market’s reaction to whoever wins the White House. We have reviewed the market’s performance in past election cycles and found the underlying trend of the market and the economy have been much more important than who wins the presidency. Stocks have been marking time since mid-July and dipped to their June 30 levels by the end of October. Stocks reached all-time highs in July (following the surprise outcome of Brexit), so a cooling off period during the summer months should not be viewed as unusual.

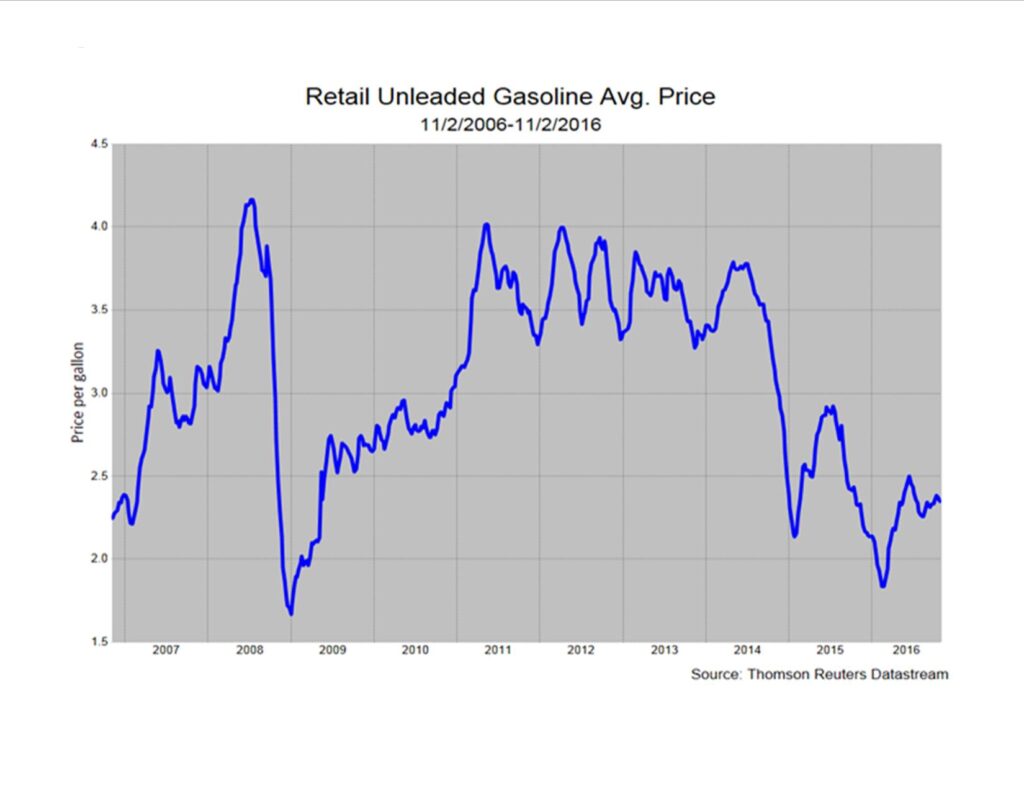

We have devoted several past Dashboard narratives to the oil markets and the impact of the US shale and fracking revolutions since mid-2014. Western oil companies are privately owned and behave in rational manners to adjust to changes in the price of oil and natural gas. Lower prices have been met by reduced spending and cutbacks in production. But, Western oil companies control a minority of global output, the remainder being owned by national governments.

Members of OPEC constitute the largest organized bloc of producers and once enjoyed a monopoly in setting oil prices (think 1970s and two embargoes on the West). National governments rely heavily on oil revenues and the plunge in prices since the emergence of the US as a dominant player has wreaked havoc on their budgets. Rather than cut output to boost the price of oil, most of these national governments have turned the spigots to full blast to maximize income at current prices.

The price of crude has dropped 10% since the middle of October as inventories have surged to record levels (talk of an OPEC cut in production has been just that, talk). The big winners are consumers as the retail price of a gallon of unleaded gas is heading toward $2 in Indianapolis. Santa has come early this year and no one is complaining.