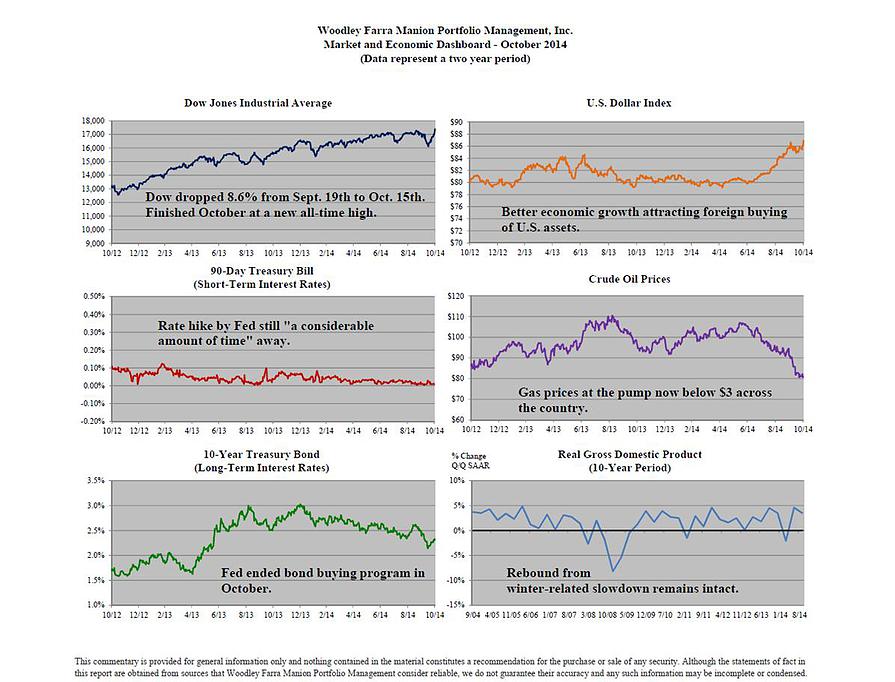

Right on queue the stock market swooned in early October, as it has done many times in the past, earning its reputation as the most frightful month of the year. All three major indexes (Dow 30, S&P 500 and NASDAQ) set a new high on September 19th and each dropped between 8% and 10% by October 15th. The Dow had a 460 point drop by midday on October 15th and then rallied sharply to close at a much lower loss by the end of the day. This intra-day “reversal” is often seen at the bottom of a correction.

The market’s new rally was turbocharged on October 31st when the Bank of Japan announced a surprise increase in its own version of the Fed’s quantitative easing program (i.e. the central bank purchases large amounts of government bonds to boost liquidity in the economy). The BOJ has taken a bazooka to jolt the Japanese economy from a decades-long slump and snap out of a deflationary spiral. Markets around the globe cheered the news and the three major indexes in the US closed at or above their highs from September 19th.

The other big news the last week of October was that the US economy grew at a more rapid annual clip of 3.5% in the third quarter. We all have fresh memories of last winter’s very negative effect on the economy, and the bounce since then has been encouraging. But, anyone walking the streets in the Midwest on Halloween saw a bitter harbinger of the coming winter. Let’s hope it’s not as bad as last year, if only to keep the economic momentum at its current pace.