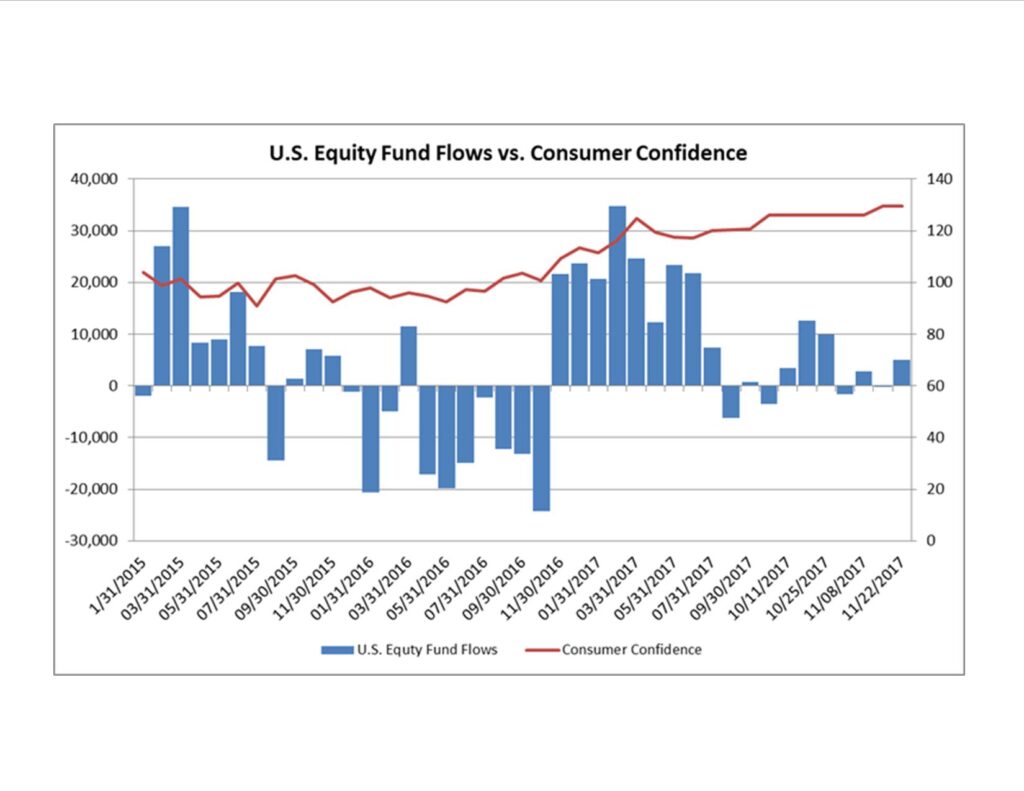

There’s an old stock market indicator that suggests that the direction of fund flows—money going into and out of mutual funds and exchange-traded funds (ETFs)—is a contrarian predictor of future stock market returns. In other words, individual investors are really bad at timing and typically buy when they should be selling and sell precisely when they should be buying. As those investors watched their portfolios lose nearly half their value through 2008 and into 2009 a lot of them exited their equity positions, just in time to miss out on the stock market’s recovery. So where are we today? Does the data suggest a correction is on the horizon as many pundits are predicting?

The contrarian indicator is just one of the many indicators that’s out there and is by no means perfect. In addition to fund flows some related indicators we track are the Consumer Confidence Index and the AAII Sentiment Survey which measures whether investors are bullish, bearish, or neutral about stock market returns over the next six months. Looking at the indicators allows us to see if investors are putting their money (Fund Flows) where their mouths are (Consumer Confidence, AAII Sentiment Survey).

Following the election there was a noticeable increase in flows into equity funds, consistent with the highest bullish sentiment in nearly two years. While steady inflows into equities continued into the first half of 2017, the latter half has been more tempered. Since June, investors have pulled $53 billion out of domestic equities, while $83 billion has been invested in international funds. In fact, since the beginning of 2015 investors have withdrawn $220 billion out of U.S. equity funds and invested that amount, plus some, in international funds.

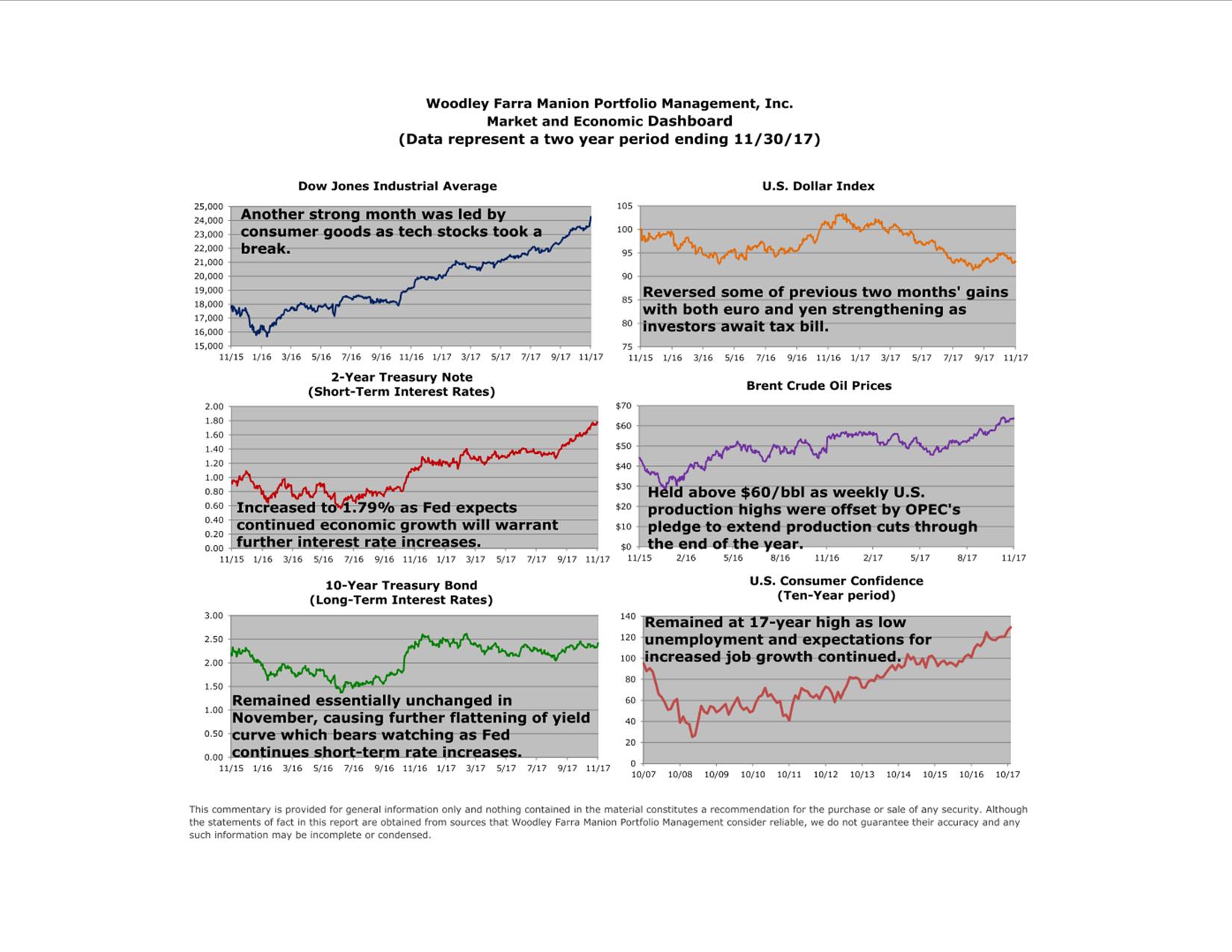

In spite of investors pulling money out of domestic equities, consumer confidence remains at a 17-year high. In addition, over this time the average bullishness sentiment has been around 33% vs. the long-term average of 39%, with less than 20% of observations above that long-term average. Compare this to the run up to the tech bubble and the Financial Crisis when over 70 percent of observations were above the long-term average. With confidence still high, tempered bullishness and the lack of consistent flows into domestic equity funds may actually prove to be boosts to the domestic equity markets going forward. We don’t see an imminent catalyst for a near-term correction and right now consumer confidence and the contrarian indicators would lend support to that belief.

Elliott Holden, CFA