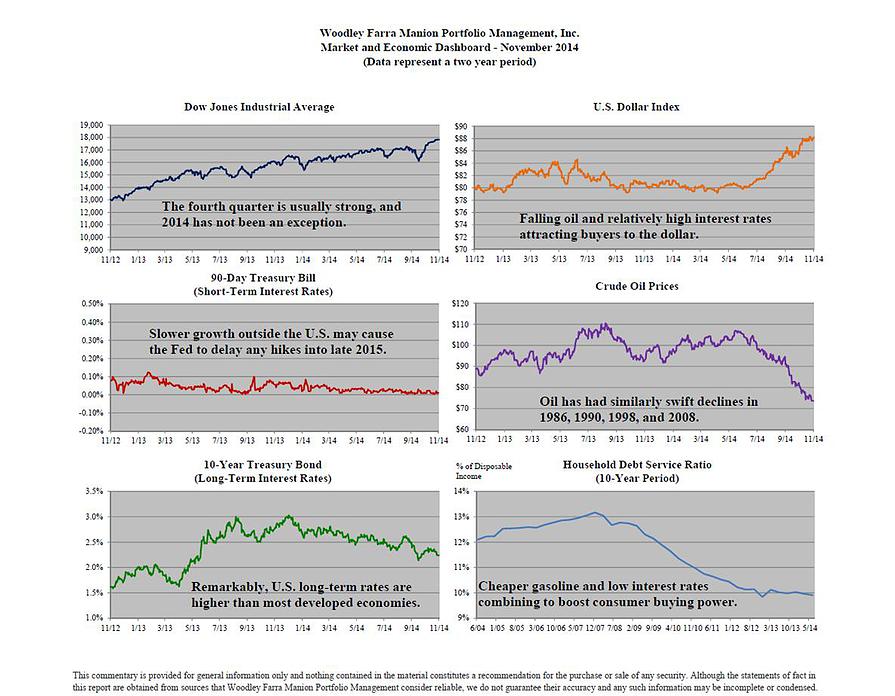

Previous Dashboards have mentioned the remarkable resurgence in crude oil production in the United States in the past five years. New drilling methods in tight shale formations ranging from Pennsylvania to North Dakota and south to Texas have released huge new reserves of crude for domestic consumption. Oil being a global market, the surge in new supply combined with flat global demand has finally caused prices to drop in a very dramatic fashion, from a high of $110 per barrel in late 2013 to the current level of about $65 per barrel. Gasoline prices at the pump are now comfortably below $3 per gallon for the first time in years, just in time for the holiday shopping season.

Meanwhile, OPEC has chosen to keep their already high levels of crude production intact, triggering calls of a “price war” with American shale producers. The story goes that the new shale wells cost more to produce a barrel of oil and a lower market price will force a reduction in US daily production. This is true to some extent, but wells that have been up and running already have the major upfront costs comfortably covered. New wells may be delayed or cancelled but the current level of production (the US is now the #2 producer in the world behind Saudi Arabia) will probably be maintained unless oil prices fall from the current level of about $65 per barrel all the way down to approximately $40 per barrel.

The global marketplace always has winners and losers, and the crude market’s losers are mainly the countries that need $100 per barrel oil prices to balance their national budgets, including Russia, Iran and Venezuela. Stay tuned for any geopolitical tensions resulting from a lack of cash to keep those populations happy.