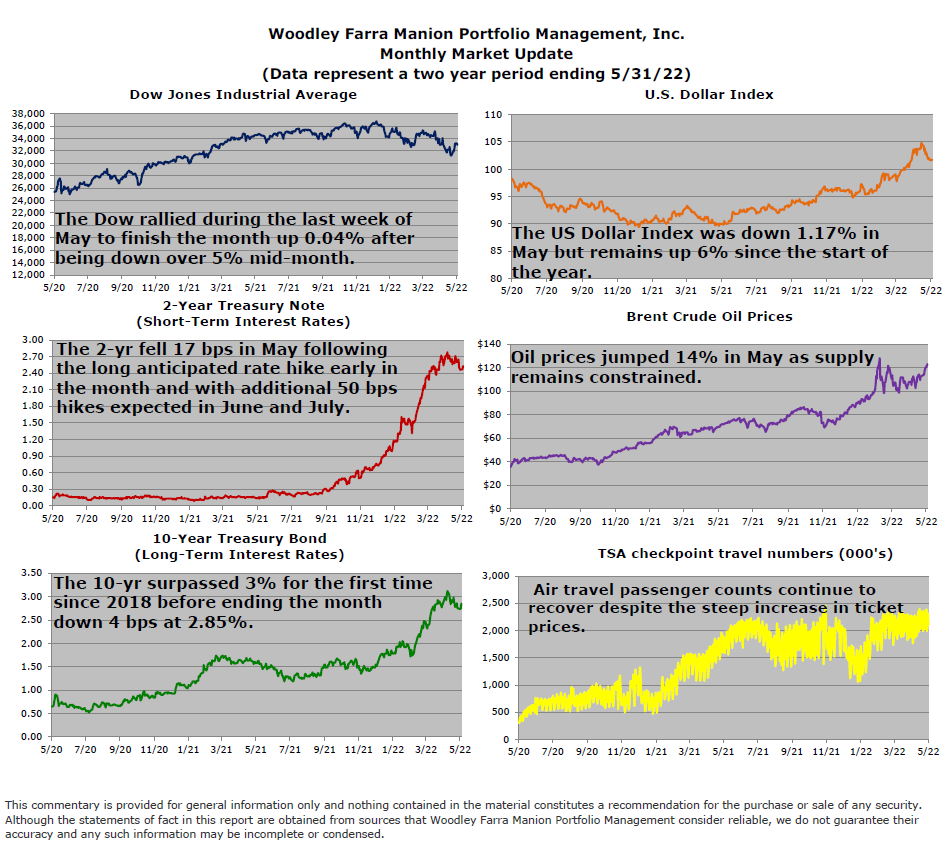

Major stock market indices ended the month of May roughly flat, following a poor April. 2022 has been a challenging year for risk assets. In general, riskier parts of the market have shed more than the broader market, as one might expect during periods of elevated volatility. Year-to-date, the Dow Jones Industrial Average, composed of well-established large-capitalization stocks, is down -8%, while the broader S&P 500 has shed -13%, followed by the traditionally more volatile Russell 2000 (small-caps) at -17% and the Nasdaq Composite -23%. The Renaissance IPO Index, which tracks companies that went public in recent years (often fast-growing, but money-losing) is down -46% so far this year. To summarize, not all stocks, or portfolios (baskets of stocks) are being treated equally. Higher interest rates and a moderating economy are leading to a pull-back in investors’ risk attitudes. Mitigating large declines is an important aspect of long-term investing, due to the nature of compounding. For instance, a -50% decline requires a +100% gain just to get back to even, while a -10% decline requires a gain of just 11%.

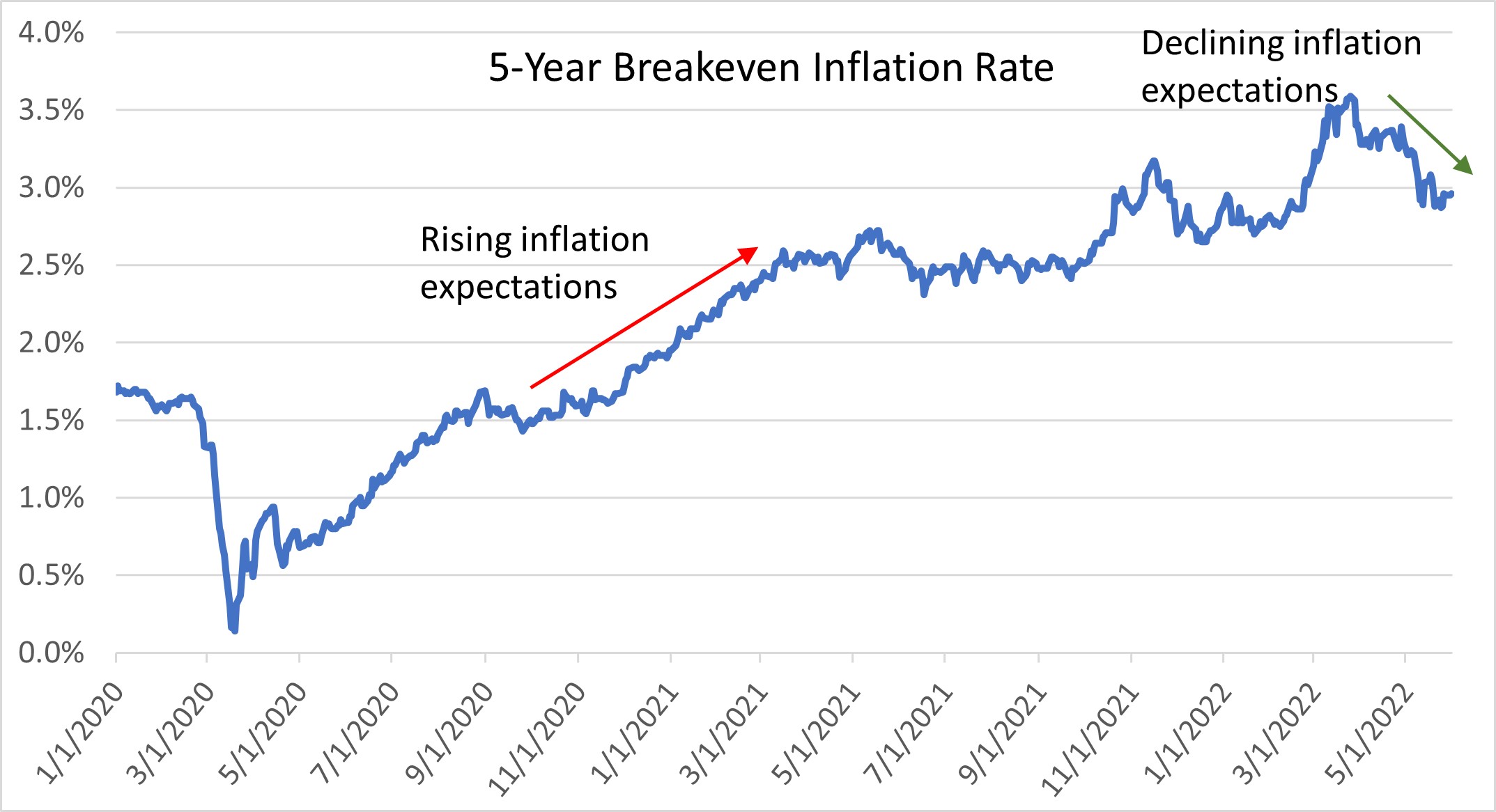

Another important development in May is the market’s cooling inflation expectation. The chart below shows the bond market’s five-year (annualized) breakeven inflation rate; what the market is pricing in future inflation to run at over the next five years. The breakeven rate peaked at 3.6% in late March and since fell below 3%. The market is beginning to take the Federal Reserve’s talk of combating inflation seriously. There are good reasons to believe inflation, on a year-over-year basis, may have peaked (lapping of war in Ukraine, moderating demand in the housing market and retail sales, rising U.S. energy production). But the persistence of elevated levels of inflation remains a key concern for policymakers and markets. Inflation moderating from >8% to 5% and holding for years is not a win for consumers. The moderating rate of inflation expected by the bond market suggests persistent inflation may not be in store.

-Jared J. Ruxer, CFA, MS