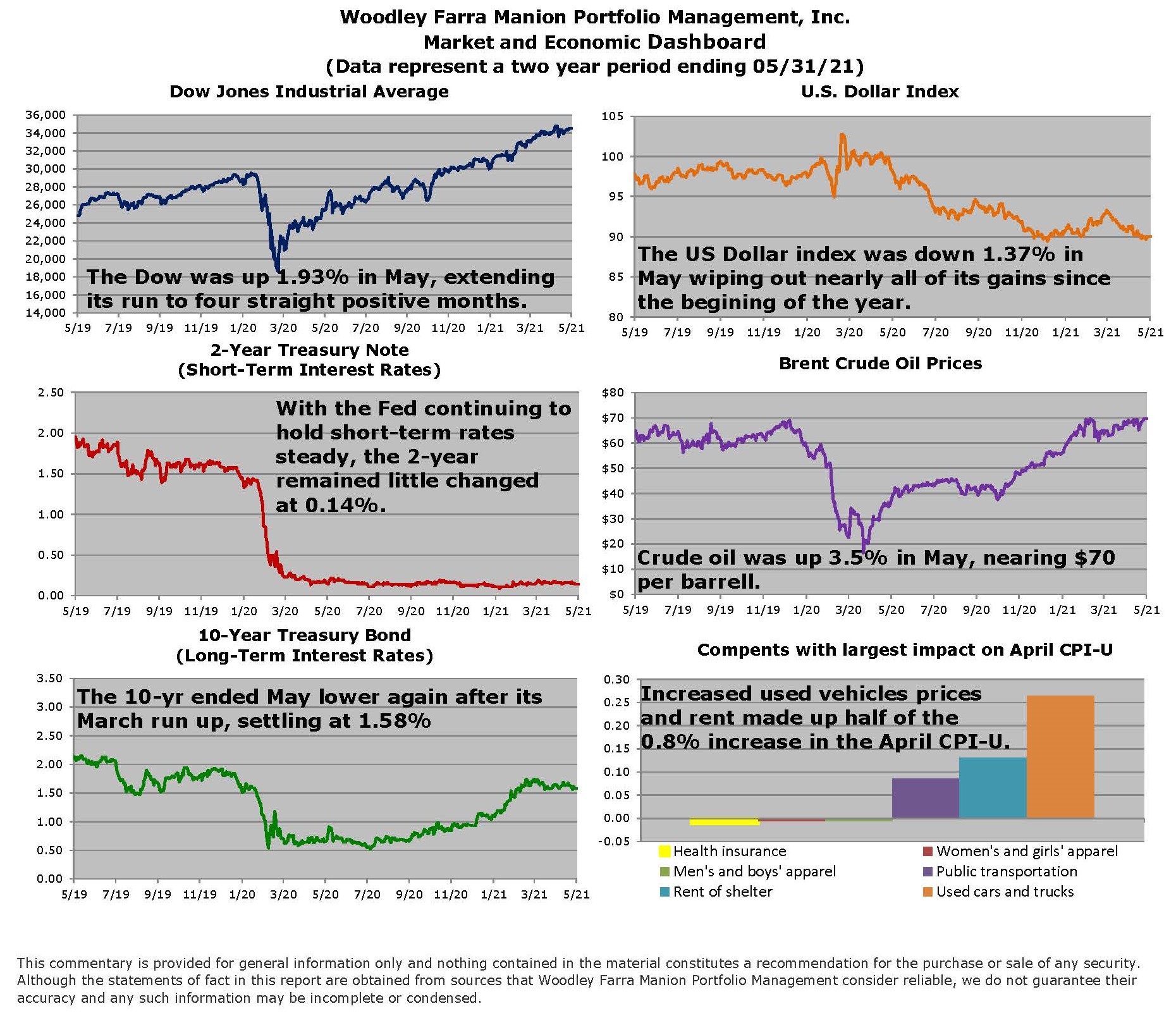

The S&P 500 index managed a modest gain of 0.5% in May on muted volatility. Inflation continues to dominate headlines as several commodities reached all-time highs and consumer price indices saw their largest spikes in decades. The major central banks of the world continue to view recent inflation as transitory. The Federal Reserve is willing to allow inflation to exceed the stated 2% target for a period of time, so long as expectations for longer-term inflation don’t rise significantly.

Inflation has varied widely across categories, especially since the start of the pandemic. Inflation has generally been most pronounced in industries where supply was negatively impacted from the pandemic and demand recovered very quickly. Used car prices surged more than 10% month over month in April and 21% year over year as new auto production declined due to semiconductor supply issues. In contrast, education and medical related inflation categories were up a more modest 2% year over year.

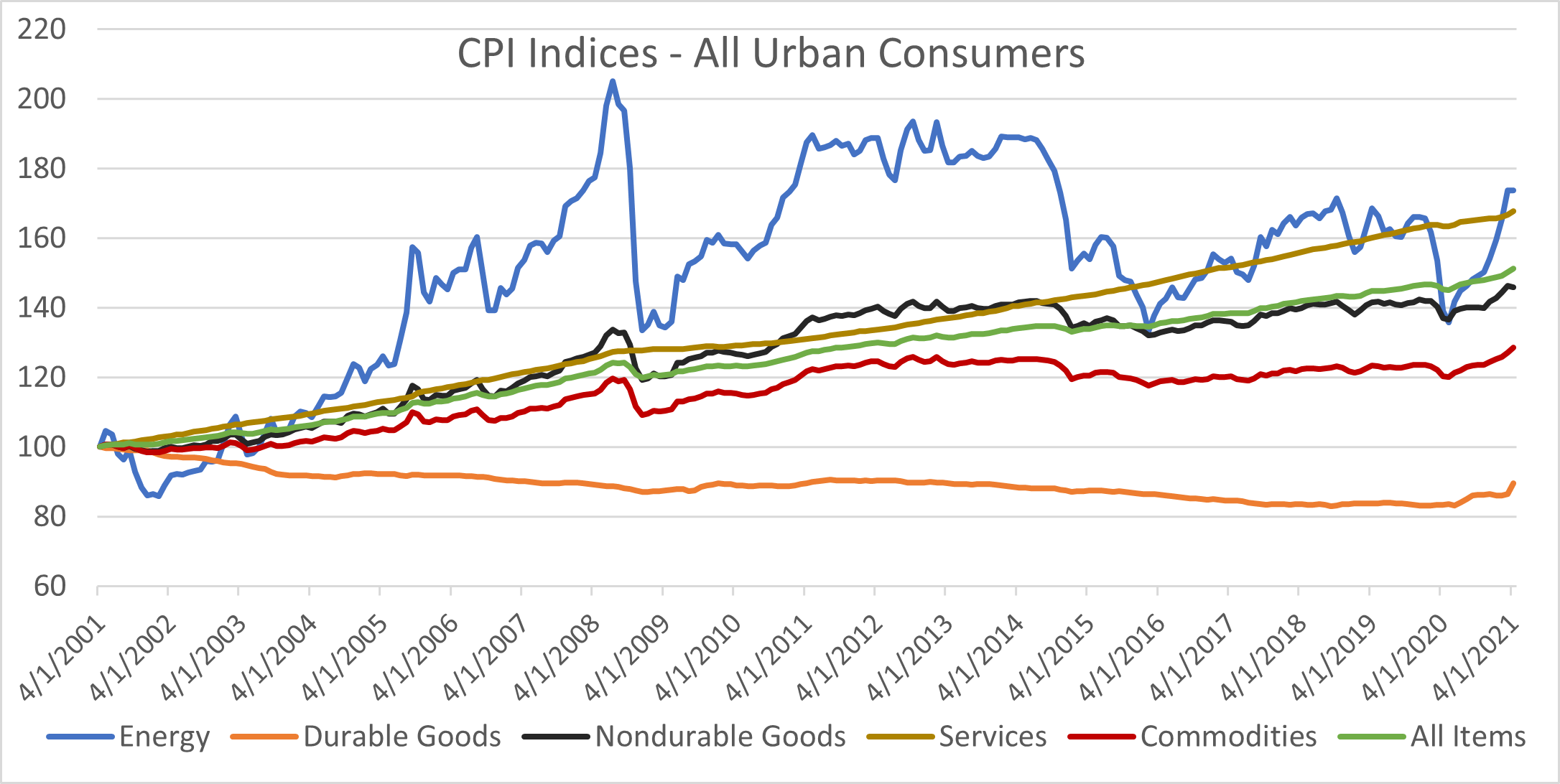

The chart below shows changes in consumer price indices over the last 20 years by a few of the largest categories. Notice that goods, energy, and commodity inflation was nonexistent from 2011-2019. Services were the primary inflationary force (led by education and healthcare). 2020 reversed this trend, as consumers rapidly shifted spending to goods and away from more COVID impacted services like travel. As demand shifts back towards services and supply chains normalize, some inflationary pressures on goods may ease, pulling down the overall inflation numbers. Rising labor costs and/or a weakening dollar (resulting in higher commodity prices) likely pose the biggest risks to longer-term inflation pressures. Fiscal policy has shown to be a more effective stimulant of consumer price inflation, while monetary policy has likely had a bigger role in influencing asset prices, i.e. homes. Both will continue to be watched closely as Washington debates an infrastructure bill (potentially inflationary) and the Federal Reserve begins to consider slowing treasury and mortgage-backed security purchases (potentially disinflationary).

-Jared J. Ruxer, MS