Since the economic shutdown caused by the coronavirus, the two dominant economic questions have concerned 1) the depth of the economic decline and 2) the duration of the economic recovery.

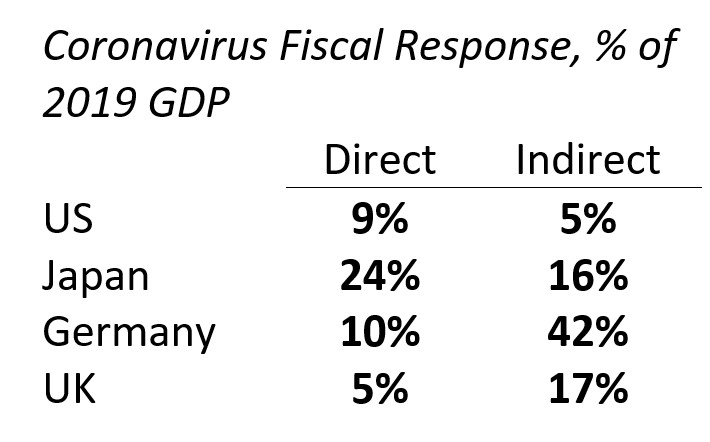

Massive global fiscal and monetary stimulus has helped reduce the depth of the economic decline. Policymakers have been aggressive in the amount of stimulus, as well as the stimulus tools used the midst of the current crisis when compared to prior downturns. The table below shows the fiscal stimulus response, as a result of the coronavirus, for several of the world’s largest developed economies. Direct stimulus includes additional spending (stimulus checks, grants, etc), forgivable loans, and tax/revenue cuts. Indirect includes all other forms of fiscal support including payment deferrals, credit lines, and non-forgivable loan guarantees. Global fiscal policymakers have made unprecedented use of liquidity related financial support (indirect). These small-business loans, tax payment deferrals, and other programs have served their near-term purpose in preventing more widespread bankruptcies and permanent business closures. Note that the US indirect response is relatively more modest than the other countries listed. This is mostly attributable to more extensive non-forgivable loan guarantee programs in other countries. These loan guarantees are likely to pack less punch vs direct actions.

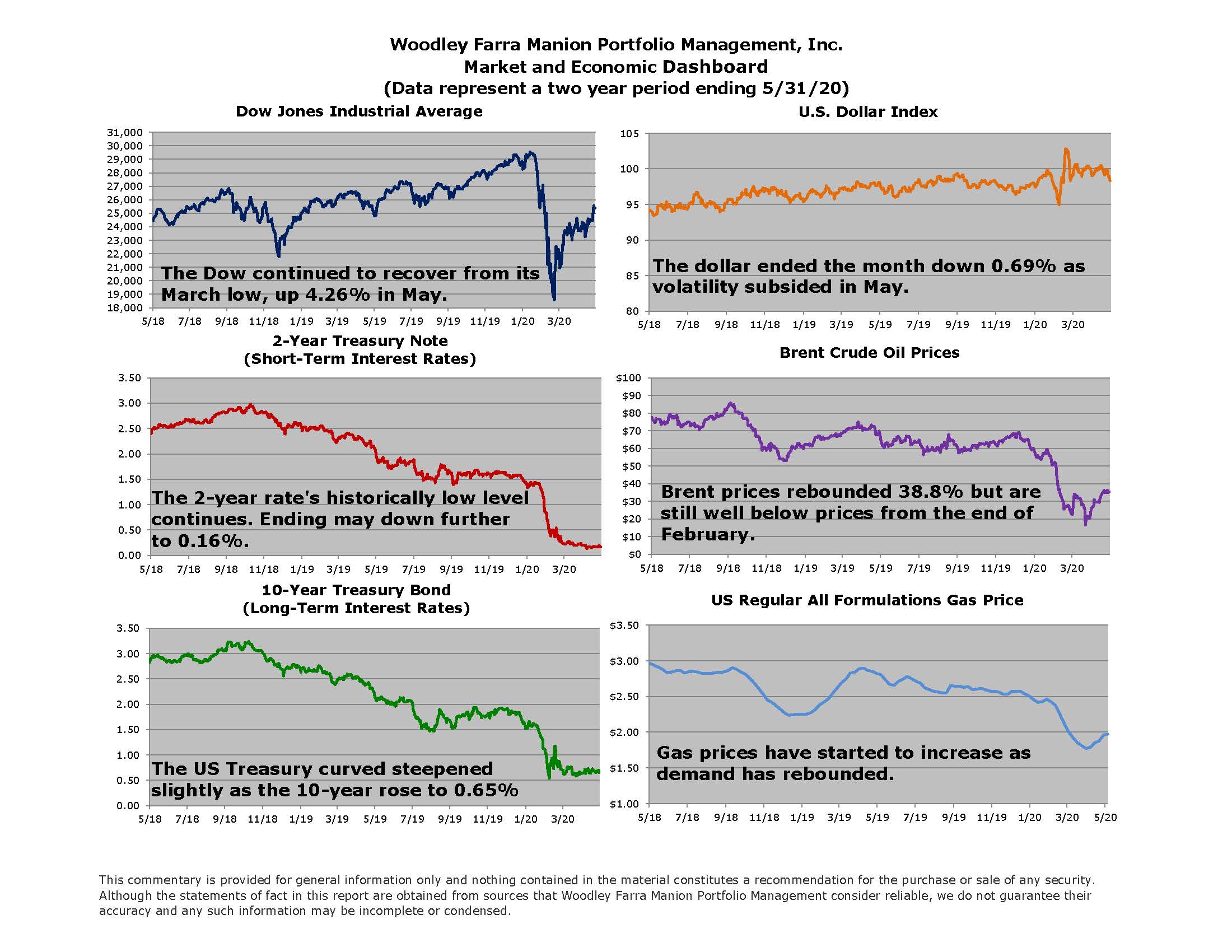

The most recent data shows encouraging signs the economic bottom is likely behind us (barring a serious second wave of infections). Continuing unemployment claims reflect the number of people who have been on unemployment for over a week. Nearly 4 million fewer Americans filed a continuing unemployment claim in the week ended May 16th vs the prior week (most recent data available). This is a much-needed indication that businesses are rehiring. On the consumption front, gasoline sales have rebounded from year over year declines approaching -50% in early April to -23% year over year in mid-May. Of course, it should come as no surprise that the loosening of restrictions and easing consumer virus fears has a positive economic impact. Nevertheless, the economy now appears to be moving in a positive direction, so the emphasis is moving towards the speed of the rebound. While fiscal and monetary policy moderated the depth (1), expect reopening policies, businesses, and the consumer to determine the duration (2) of an ensuing rebound going forward.

– Jared J. Ruxer, MS

Sources: Federal Reserve Bank of St Louis, Energy Information Administration, Reuters, Investopedia, Bruegel