Here in the Midwest it seems like Mother Nature forgot a season, sending summer in a few months early without warning. Perhaps it’s fitting given the temperature of the capital markets right now. Despite great news out of Corporate America (in part due to the tax cuts enacted last year), geopolitical tensions are heating up, keeping the indices in a trading range and still about 6-9% below their January all-time highs.

First quarter earnings are just about wrapped up and according to FactSet 78% of companies have reported positive EPS surprises, which would represent the highest percentage since they began tracking the metric in the third quarter of 2008. Positive revenue surprises from 77% of companies and a blended earnings growth rate of almost 25% also provide significant support for stocks. Add on top of that a better than average outlook going forward and some are left wondering why the indices have barely budged this year.

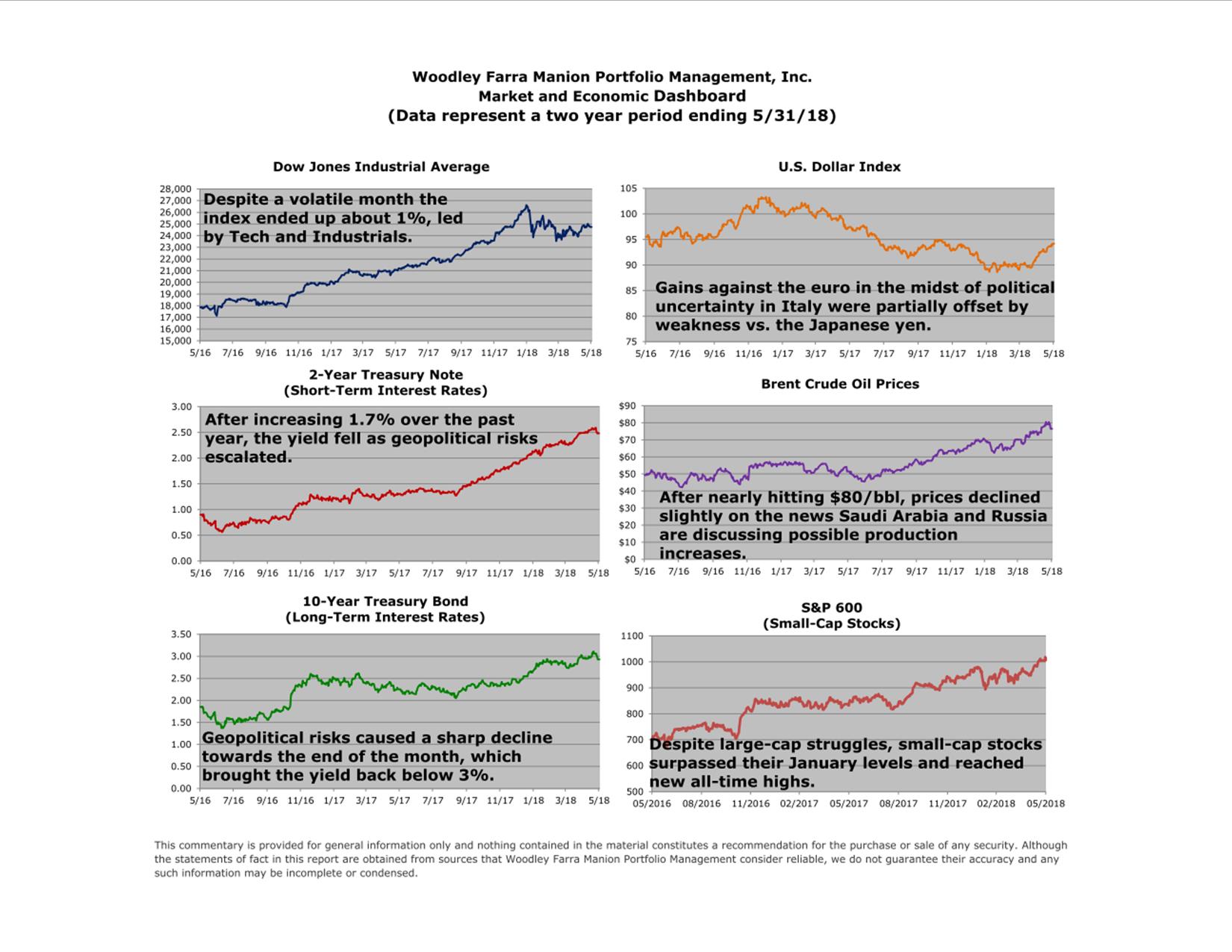

All of that positive corporate news hasn’t been enough to offset the growing list of geopolitical concerns: fallout from the scrapping of the Iran nuclear deal, the trade war with China (and as of this writing Canada, Europe and Mexico), political uncertainty in Italy which has reignited the rumors about the demise of the euro, and last but not least, an upcoming summit with North Korea.

From a corporate fundamental standpoint a prolonged trade war is the most worrisome, but given the world-wide implications we believe it should be relatively short lived. Given the strength of the underlying economy we believe a quick resolution to these trade wars could provide the boost the indices need to retest their January highs.

Elliott Holden, CFA