Here in Indy the month of May is mostly about one thing, the Indianapolis 500. As part of the auto-racing triple crown (the Monaco Grand Prix and 24 Hours of Le Mans being the other two), it’s something drivers aspire to win. Winning the race, or even just finishing for that matter, requires skill and a tremendous amount of mental endurance. The drivers certainly make the idea of making 800 left-hand turns a lot more exciting than it sounds. And since “The Greatest Spectacle in Racing” marked the start of summer we thought we’d keep the excitement going with a look at interest rates. Okay, so maybe talking about sustained low interest rates and the Federal Reserve starting to reduce their balance sheet are not any more exciting than they actually sound, but for investors they definitely matter.

How many years in a row have you heard the phrase, “interest rates have to go up”? Well, how many fingers do you have? Because the same answer probably applies to both. While interest rates have certainly been volatile over the past decade the 10-year U.S. Treasury has not yielded above 4% since April of 2010. Most readers probably remember the higher interest decades of the 70s and 80s, so given today’s low rates it’s no surprise you’re wondering when interest rates will move higher. As we look back at the history of interest rates it might come as a surprise that those decades were more of an aberration than the norm. From the end of the Civil War up to the 1960s long-term U.S. government bond yields were not above 4% very often. Going back even further, did you know many of the earliest U.S. colonies had a legal maximum interest rate of 6%?

We don’t see rates rising to 6% anytime soon (the 10-year U.S. Treasury yields less than 2.2%) and we wouldn’t be surprised to see interest rates remain around current levels for an extended period of time. Countries around the globe have maintained low interest rate policies in an effort to stimulate economic growth through increased borrowing and spending. As a result, many investors see U.S. bonds as a better, more stable investment, which has effectively kept a lid on U.S. interest rates. Additionally, investors view U.S. treasuries as safe-haven investments and will buy more of them when geopolitical risks increase (ie. ISIS, North Korea). With that said, you might be wondering what type of scenario will cause interest rates to rise?

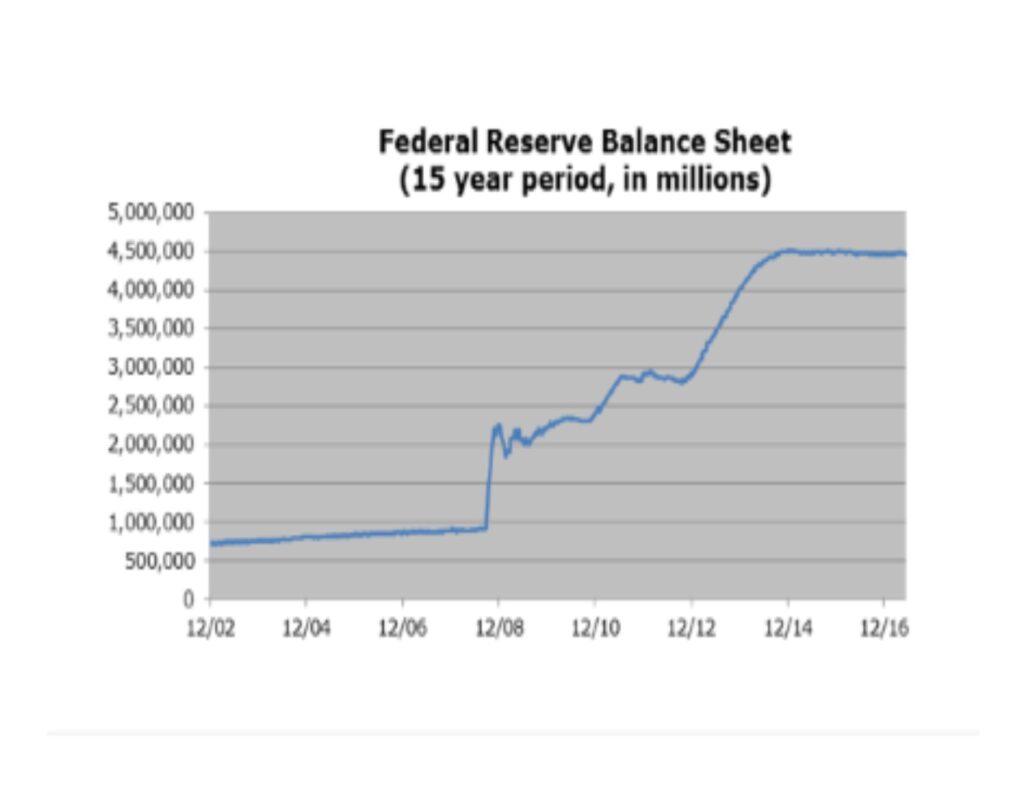

As part of their effort to drive interest rates lowers and stimulate growth following the Great Recession, the Federal Reserve bought U.S. treasury bonds and mortgage-backed securities, increasing its balance sheet to over $4 trillion. The Fed has recently stated that they’d like to explore reducing these holdings. In the most likely situation the Fed would just simply let their holdings mature without reinvesting proceeds in additional securities. While this would certainly be less of a shock to the system than large-scale sales of securities it would still result in reduced demand for U.S. treasuries. Economics says that a decrease in demand is generally followed by a decrease in price, which as you bondholders know means higher interest rates.

The key to the Fed reducing their balance sheet lies in their ability to do so at a pace the market can digest. We think the Fed will move at a slower pace so that interest rates will rise moderately. After embarking on an unprecedented bond-buying program the case study won’t be complete until we see how the Fed manages the unwinding.

Elliott M. Holden, CFA