For the second time in two years, and the third time since the end of the Great Recession, first quarter inflation-adjusted gross domestic product (GDP) contracted. The Commerce Department reported in April that first quarter GDP grew at a seasonally adjusted annual rate of 0.2%, but with its first revision in May, it now reports that GDP shrank 0.7%, largely in line with economists’ expectations. The figure could improve somewhat with the final revision later this month, but it is very likely to still report a decline in the U.S. economy for the first quarter of 2015.

Much like last year, severe winter weather was a cause for the poor results, though it wasn’t as much of a culprit as it was last year. Instead, the primary driver of the revision from positive to negative GDP growth was a larger than expected trade deficit, in which imports grew faster than exports. The increase in value of the U.S. dollar relative to foreign currencies since last summer makes it cheaper for U.S. consumers to buy foreign imports and more expensive for foreign consumers to buy U.S. exports. Other factors contributing to the lower GDP figure were the labor disruptions at West Coast ports and lower business spending.

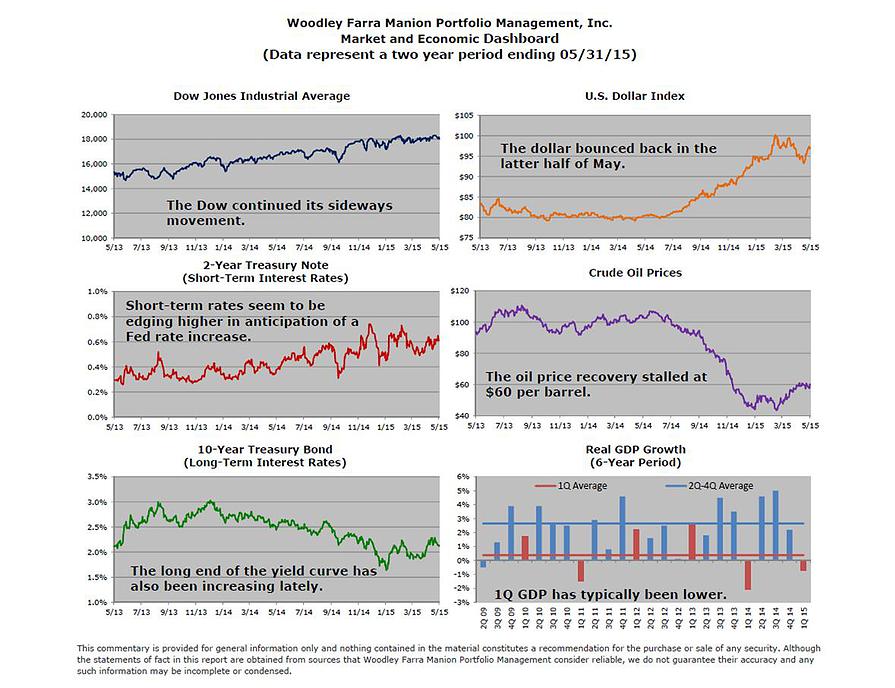

Interestingly, since the end of the recession, and even before that, first quarter GDP has tended to be lower than the other three quarters of the year. When quarterly GDP is calculated, the inputs are adjusted in order to try to remove seasonality from the number, allowing for apples-to-apples comparisons between quarters. Nevertheless, the accompanying chart shows that over the past six years first quarter GDP growth has averaged 0.4% while second, third, and fourth quarter GDP growth has averaged 2.7%. In response, the government is working on a plan to improve its estimates of GDP by mitigating what it calls residual seasonality, a statistical problem in which “seasonal patterns remain in data even after they are adjusted for seasonal variations.” If successful, future quarterly GDP reports will be less volatile around the first quarter, though full-year GDP calculations will be unaffected.

Nonetheless, second quarter GDP is expected to bounce back in much the same fashion as it did last year and contribute to a year of positive GDP growth in 2015. Other encouraging signs that point to future growth in the U.S. economy are an unemployment rate that continues to trend lower, with weekly jobless claims having recently reached their lowest level in fifteen years, manufacturing data from the Institute for Supply Management (ISM) showing positive signs, modest wage growth, and lower gasoline prices that allow consumers to spend some of those savings. All told, there is hope that this past quarter was just another bump in the road to recovery.