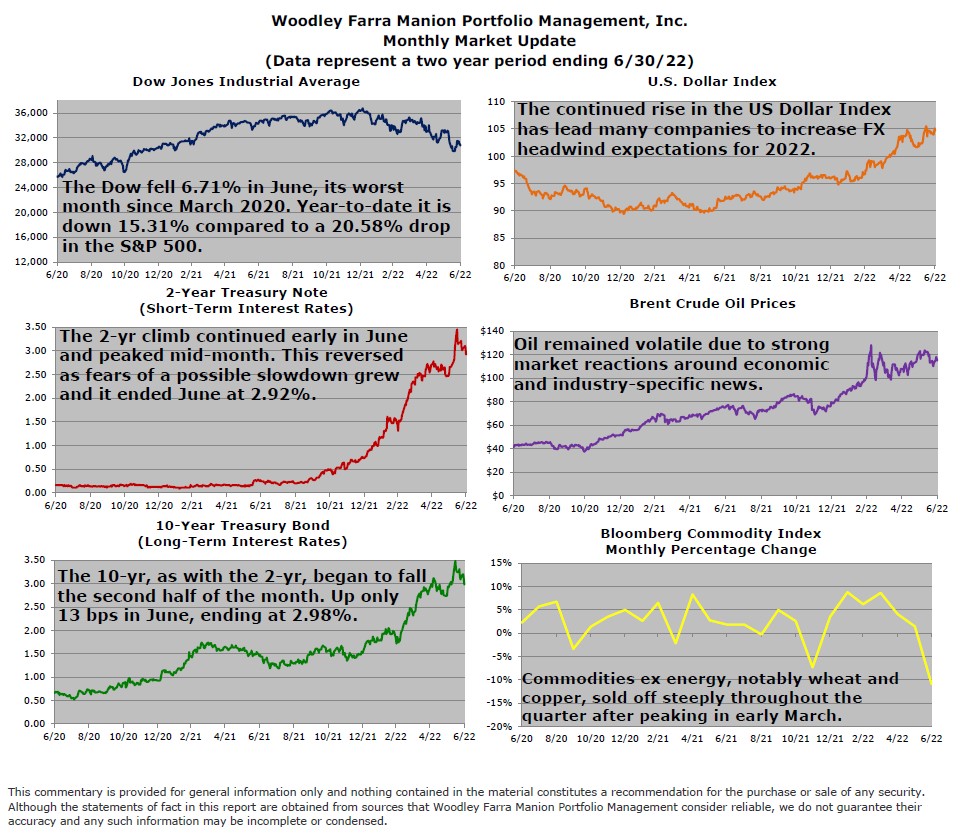

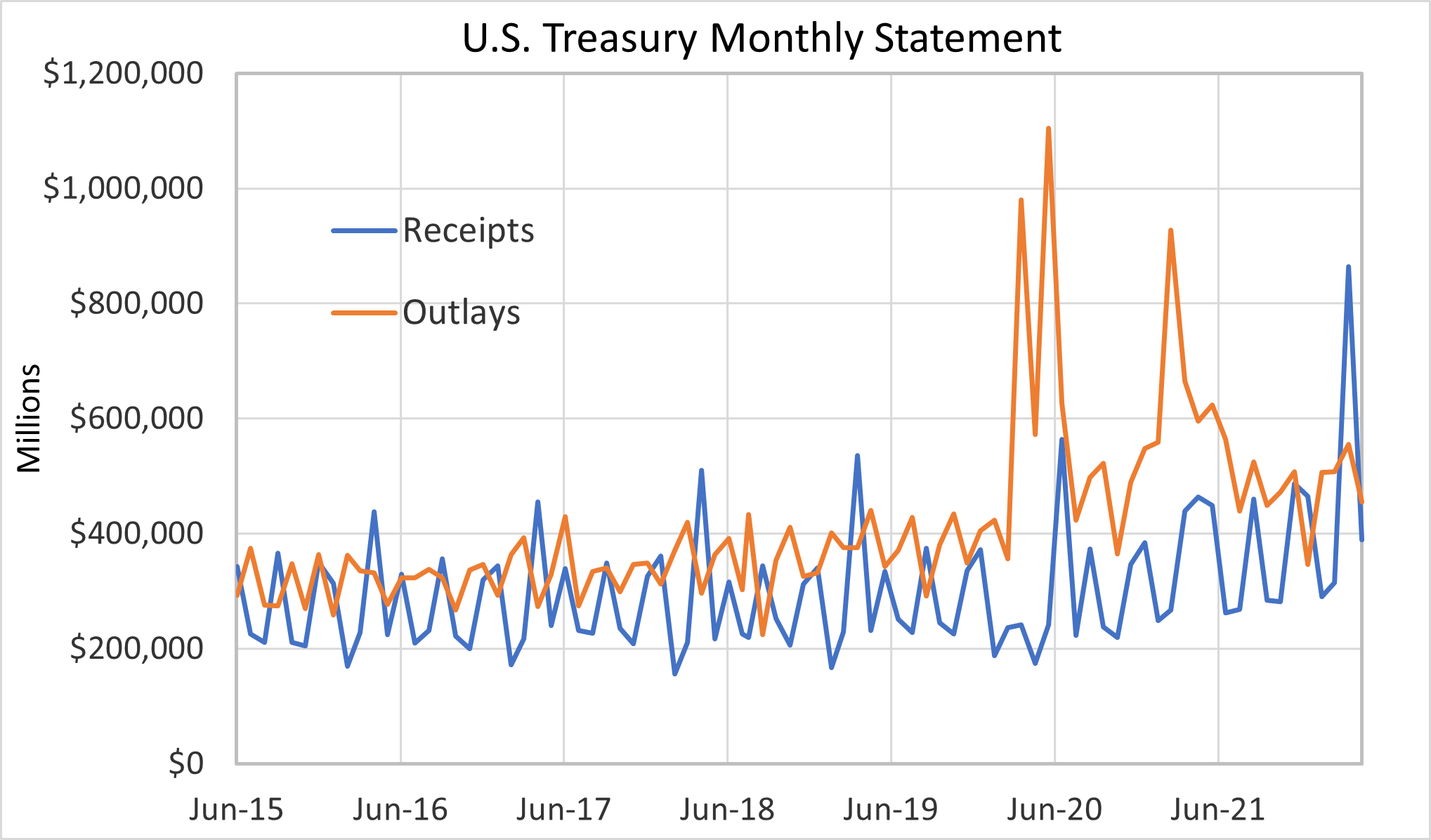

The second quarter was marked by broad declines in bond and stock prices as markets contend with rising interest rates and a weakening economic outlook. Last year, the economy and financial markets were riding a tailwind of stimulus in two forms: 1) significant deficit spending by the federal government and 2) ultra-low interest rate policies at the Federal Reserve. This year, the script has flipped, as tax revenues soar (up $768B so far in FY’22 vs. the year prior) while government spending recedes (down $870B) and the Fed gets serious about raising rates. Both conditions present headwinds to demand in the short run, slowing economic growth. Since prices are a function of supply and demand, in theory, inflation would eventually moderate with demand. But practice is messier than theory, and the government entity tasked with maintaining price stability, the Fed, only has blunt tools that cannot address supply-induced inflation. This puts the Fed in the challenging position of trying to slow demand enough to kill inflation without tipping the economy into a significant recession.

Bear markets and recessions are regular, albeit painful, features of investing. If they never occurred, far more would own stocks, resulting in stubbornly high prices and low returns. It’s important to remember that expectations drive the stock market, so stocks generally lead economic conditions. This means stocks often bottom and begin a new bull market even as the economy continues to soften. Of course, not all stocks are equal. Those with reasonable valuations, pricing power to withstand inflation, and resilient financial strength are well-positioned for a wide variety of potential economic outcomes in the months ahead.

-Jared J. Ruxer, CFA, MS