The stock market continued the rally from the Christmas Eve low that marked the end of the fourth quarter “mini” bear market. Stocks at that time fell due to fears the Fed would continue to increase short-term interest rates to levels that would lead to a recession. The Fed has since held the line on rate hikes and the market is anticipating a cut in the Fed Funds rate at the end of July Fed meeting.

The chart above is indicative of why the market is expecting a rate cut. The Fed has several tools to manage short-term interest rates (Fed Funds rate) and the money supply (interest paid on excess bank reserves). The Fed began to pay interest on the latter during the 2008 Financial Crisis and has continued this program as an outlet for banks to earn extra income on funds they are not lending.

The interest paid on excess reserves program may now be counterproductive. Note the 3-month T-bill is now yielding less than both the Fed Funds and interest on reserves. Banks now have an extra incentive to just simply deposit money at the Fed and earn a risk-free rate of 2.25% rather than lend money.

Every dollar deposited by a bank at the Fed is one less dollar in the economy. The Fed has been reducing its holdings of government securities as well, which also reduces the money supply. Both have combined to act as a drag on the economy since last fall. A rate cut and large reduction or elimination of the interest paid on reserves will communicate to the economy the Fed is firmly committed to expansion and inflation fears are a secondary concern.

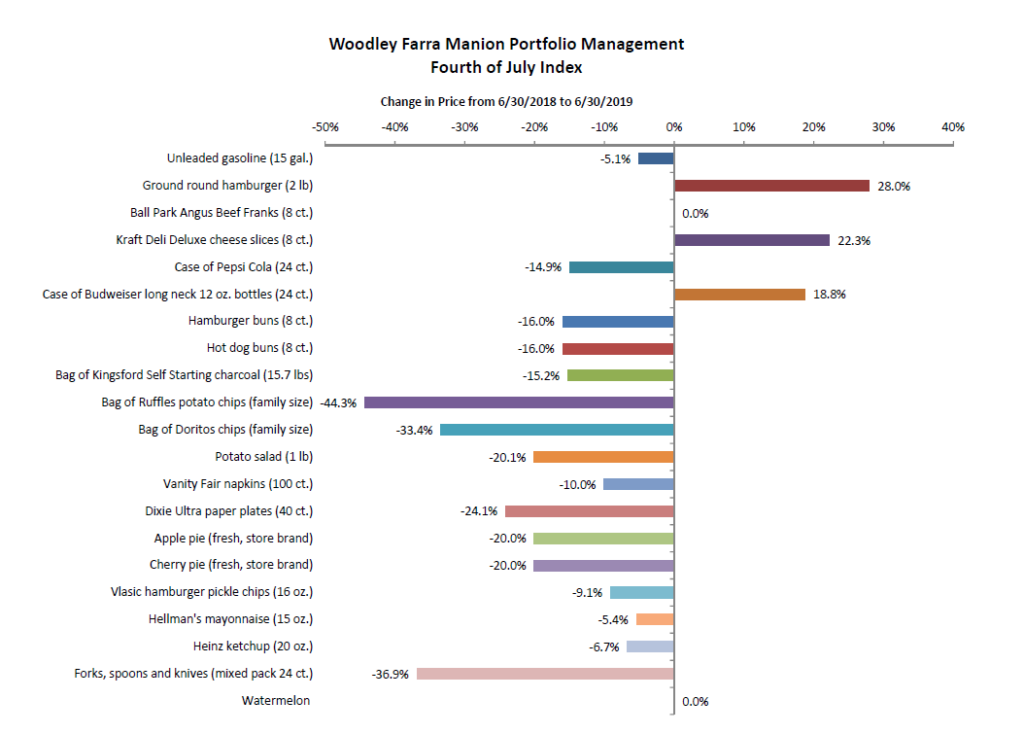

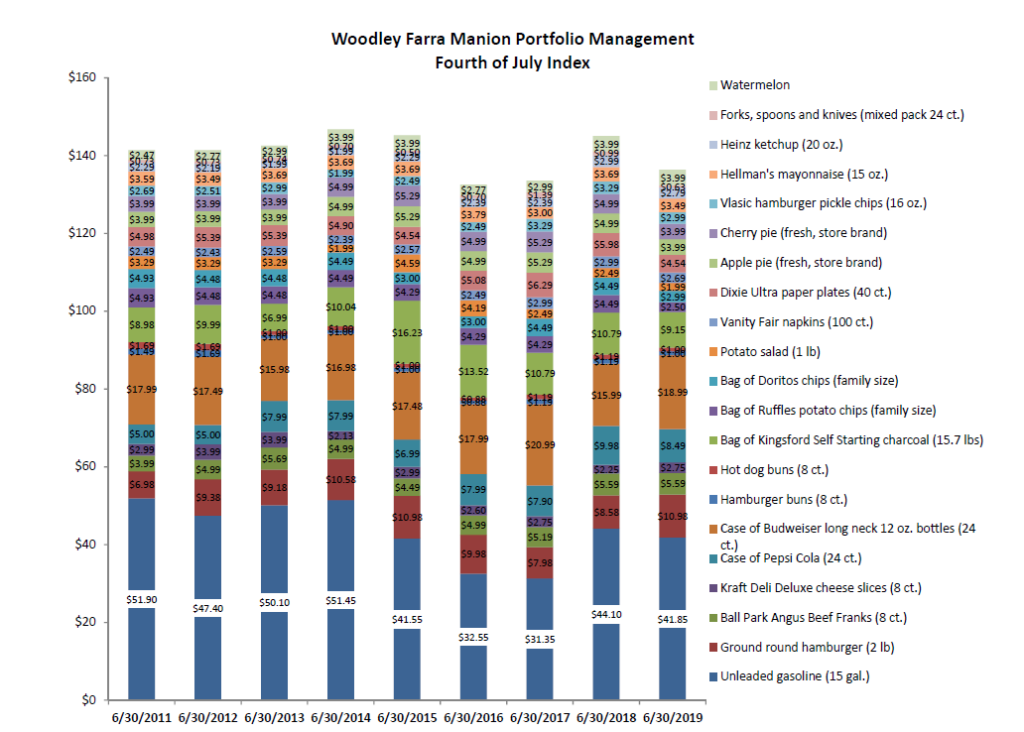

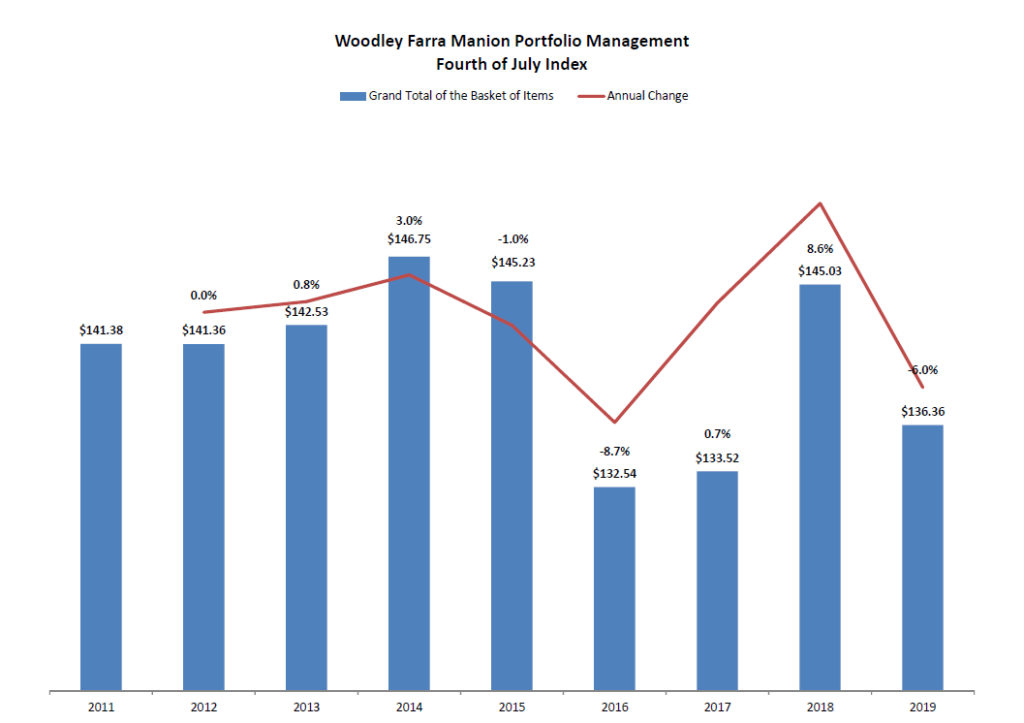

Additionally, the annual Fourth of July Index is below. We hope you find the information useful and entertaining!