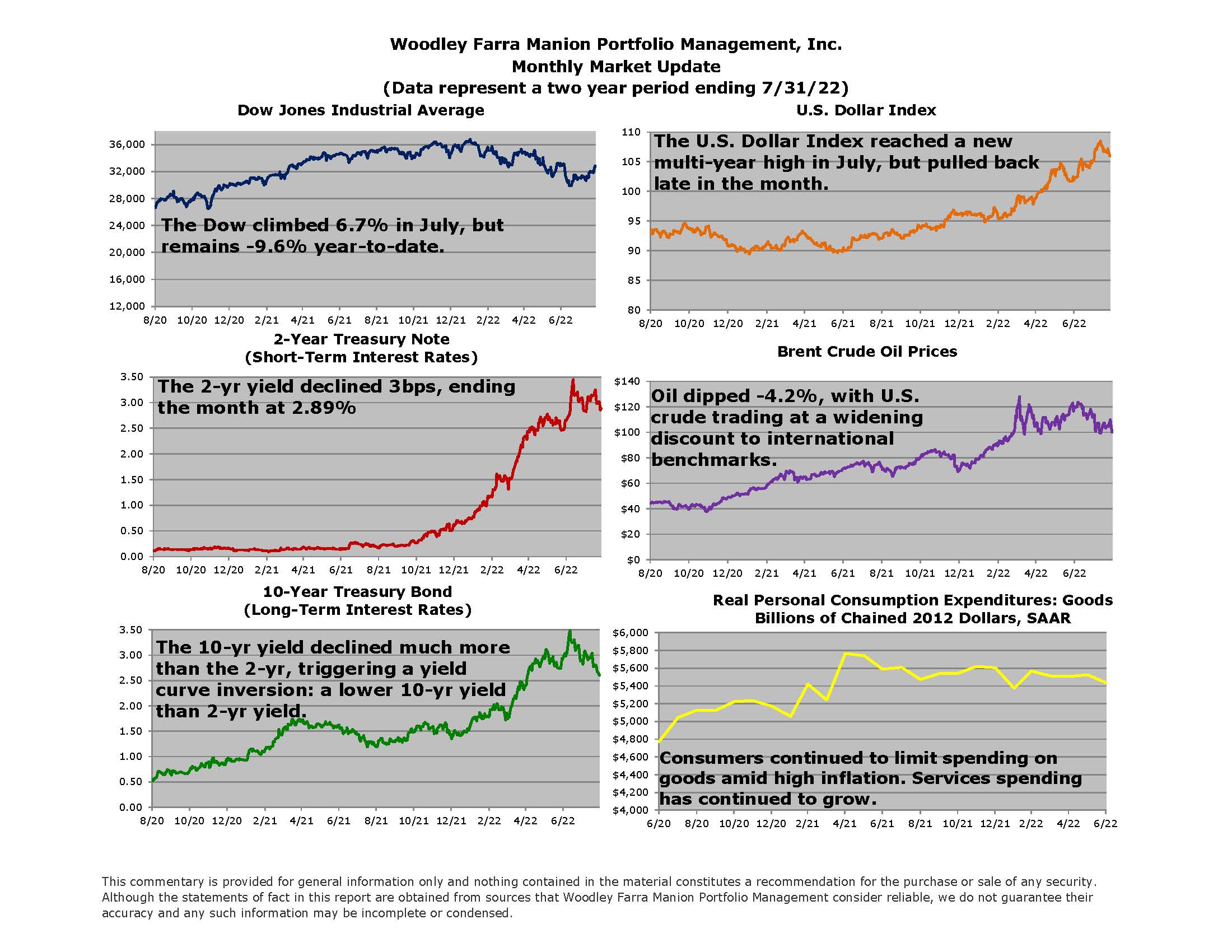

Stock and bond markets rallied in July, providing some consolation for 2022’s poor first-half performance. Despite high inflation data in June, some investors felt optimistic about the potential for inflation to moderate. Most commodities, including gasoline, copper, lumber, wheat, and corn, saw sharp declines. Import prices also fell, aided by the strong dollar and slowing consumer spending on goods. Nevertheless, it would be premature to declare victory on inflation as other key categories show little sign of slowing.

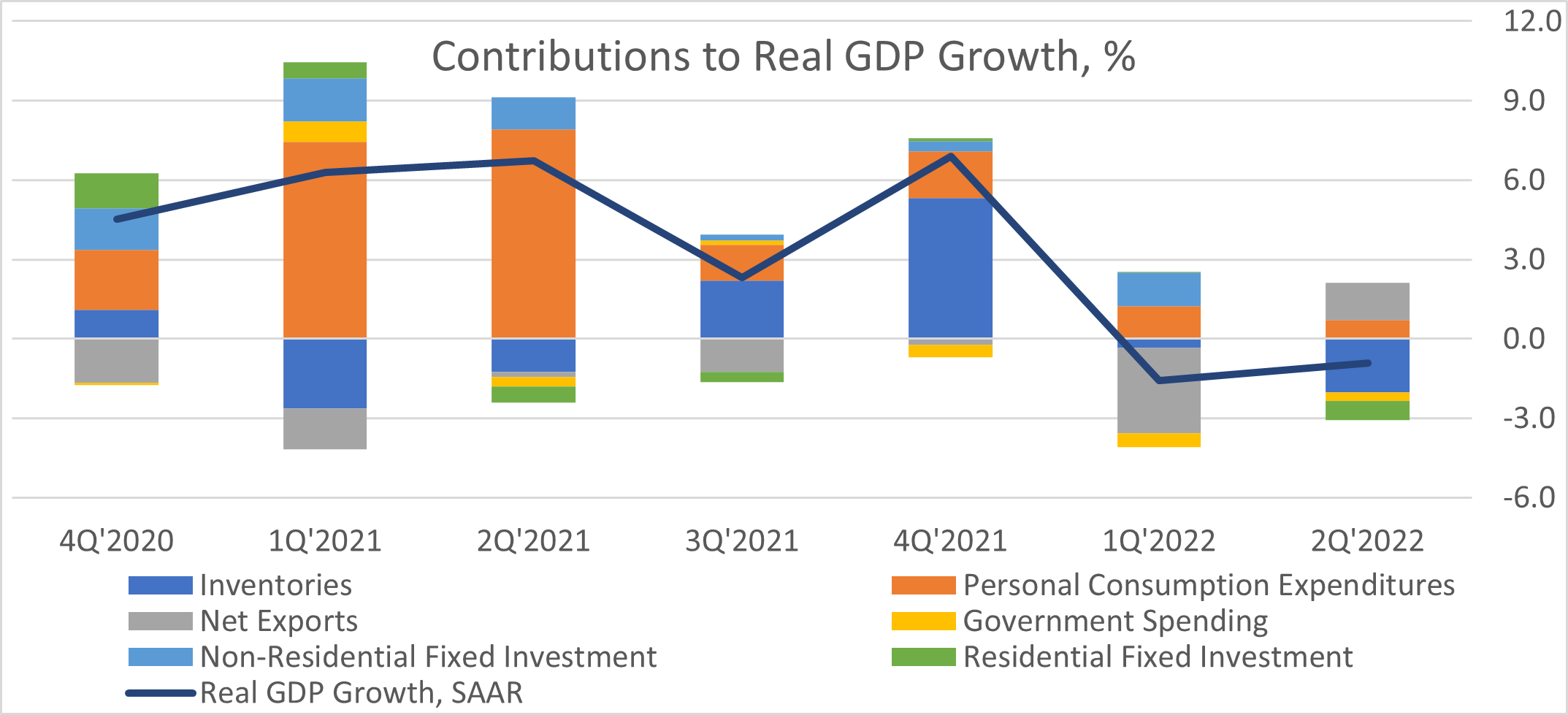

Second quarter gross domestic product data was negative for the second consecutive quarter, spurring debate over the very definition of recession and whether the U.S. is currently in one. Both sides mostly talk past each other, as one argues in favor of the widely held, simple formula of two straight quarters of negative GDP growth equating to a recession. The other defers to the National Bureau of Economic Research’s eight-person board to categorize recessions based on an economic slowdown’s depth, breadth, and duration. The NBER’s definition is retrospective, waiting months to declare peaks and troughs in economic activity, making it a poor indicator of current or forward-looking economic conditions.

The chart below shows the main categories comprising GDP growth (bars) and total GDP growth (line). Some categories tend to be extremely “noisy”; pushing GDP growth around quarter to quarter while offering little signal on the underlying economy. Inventories (dark blue), net exports (grey), and government spending (yellow) tend to fall in this category. Economists are loathe to cheer strong GDP growth fueled by these volatile categories. The 4th quarter of 2021 is one such example, where 6.9% growth is less impressive when considering 5.3% came from inventories. On the other hand, personal consumption and fixed investment (factories, equipment, R&D, housing, etc.) are considered healthier, more meaningful indicators of growth. These categories contributed 2.5% and 0% to GDP growth in Q1 and Q2, respectively, while the “noisy” categories detracted -4.1% and -0.9%. Economic activity may not have been quite as bad as the 1st half’s GDP headline numbers indicate, but the economy has slowed dramatically. Moderating inflation and very slow economic growth may be the best-case scenario for markets through the remainder of the year, putting less pressure on the Fed to continue pursuing aggressive rate hikes. Economic data will be critical in the coming months to assess how cross-sections of the economy absorb the impacts of higher rates and low growth expectations.

-Jared J. Ruxer, CFA, MS