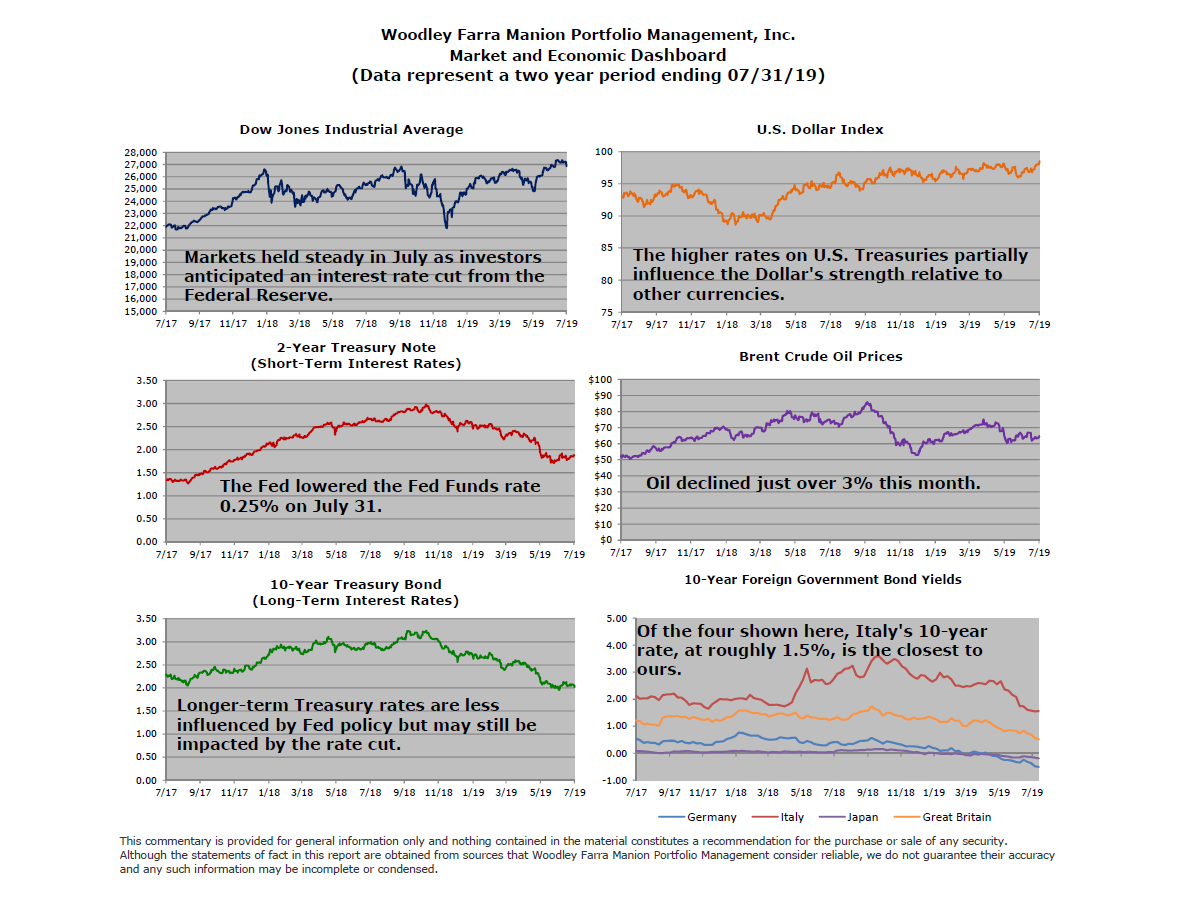

After a relatively good month for the stock market in July, the one-two punch of a disappointing Fed rate cut on July 31 and more tariffs on Chinese goods and its retaliatory currency devaluation in the first days of August have sent stock prices sharply lower. Markets like predictability (which usually comes at a premium) and the Fed’s muddled message about adding more support to the economy in the coming months was poorly received. US economic growth has decelerated in 2019 as the impact of tighter money since 2017 worked its way through the economy.

The escalating tariff battle has added more pressure on corporate spending. The second quarter GDP growth of 2.1% was paced by good gains in consumer and government spending. Corporate spending declined during the quarter due to the uncertainty to any resolution of the tariff war and Fed policy as well.

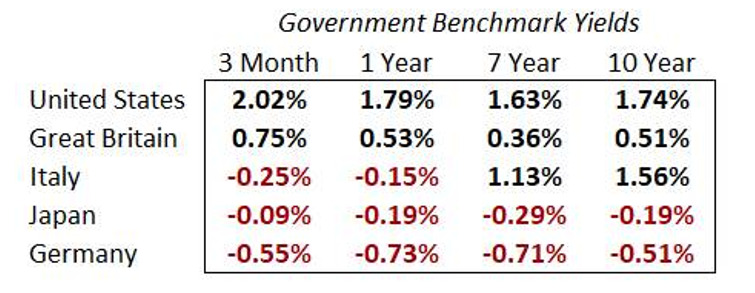

One factor that serves as a monetary tightening is the strength of the US Dollar, which has increased nearly 4% against a basket of trading partner currencies. A significant factor linked to the strength is the US has positive interest rates. The Euro Zone and Japan have negative interest rates for nearly all the government debt in circulation. Both regions’ economies are not competitive with the US, but they are slow to reduce taxes and deregulate to jump-start growth. Cheaper currencies are therefore utilized to export their way to prosperity. A beggar-thy-neighbor approach via weaker currencies probably won’t work and savers in those countries are paying the price of this strategy.

The following chart illustrates the differential between US interest rates and our major trading partners:

There is much to be optimistic about for the US economy for the balance of 2019. Job growth remains strong, annualized wage growth is 3% or better most months, consumers are saving at a high rate and debt remains comfortably low. Consumer confidence is at very high levels, and the lack of new debt seems to signify greater appreciation for thrift. August and September are traditionally weak months for the stock market and the current news-driven move lower fits this seasonal pattern. But the overall condition of the market remains favorable for investors who take a step back and look past the headlines.