July 2015 Economic Dashboard

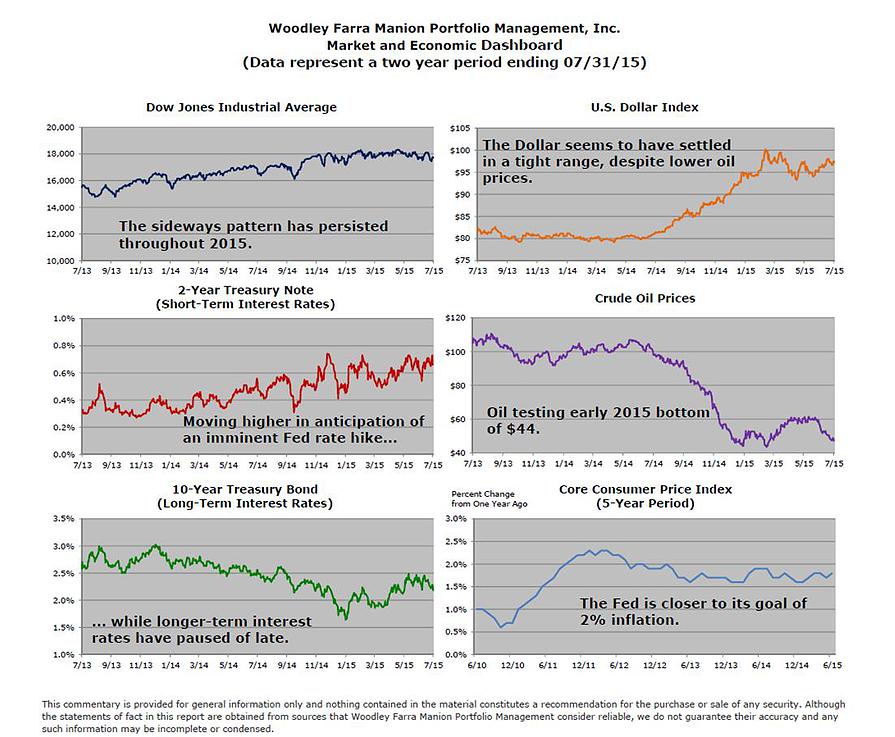

So, will the Federal Reserve raise short-term interest rates in September or wait until closer to the end of the year? Given the uneven economic data, collapse in commodity prices (often a sign of weaker economic growth ahead) and slowdown in China, will the Fed pull the trigger sooner or later?

Monetary policy involves, among other activities, setting short-term interest rates and managing the money supply in the economy. The goal is to establish equilibrium between the supply and demand for money that allows for good growth without generating too many inflations pressures. US economic growth since 2009 has been slower than prior post-war recoveries and inflation has been quite subdued as well. The drop in oil prices in the past year (and large reduction in prices at the pump) has provided the Fed with more time to assess the strength of the recovery.

Following are a few factors in favor of boosting the Federal Funds rate from zero to 0.25%:

Unemployment is 5.3 % and the economy is averaging over 200,000 new jobs per month.

Steady readings of growth in manufacturing, particularly in Europe, indicate consistent demand.

Lower commodity prices are reducing inflation pressures throughout the economy.

Banks are reporting growth in a variety of consumer loans, indicating both a willingness to lend and a renewed appetite for debt.

Arguments against a rate hike include:

The participation rate in the labor force is near a 40 year low, meaning scores of disappointed workers have dropped out of the workforce.

Wages have barely grown in the past few years.

Home ownership rates are at a 30-year low, despite record low mortgage rates.

Capital spending by businesses remains well below levels seen in prior recoveries.

It has been nine years since the Fed last raised short-term interest rates. The Financial Crisis has ended, as has the Great Recession. Zero percent interest rates have hurt savers (mostly retirees) as they have subsidized borrowers. Finally, zero percent sends a message of no-confidence to consumers and businesses alike, that the economy cannot stand on its own without the Fed lending a hand. We expect the Fed to raise interest rates in September and thus begin the new era of the “Great Normalization” as interest rate policy returns to a more traditional approach.

This commentary is provided for general information only and nothing contained in the material constitutes a recommendation for the purchase or sale of any security. Although the statements of fact in this report are obtained from sources that Woodley Farra Manion Portfolio Management consider reliable, we do not guarantee their accuracy and any such information may be incomplete or condensed.