One month into 2020 and the market has already had two major unexpected events thrown its way. Stocks shrugged off US-Iran hostilities quickly but have encountered additional volatility during the recent coronavirus outbreak. We’ll leave the health debate to the virologists, but it is important to consider the economic implications for China, and more importantly, the world. The initial market response has been a sharp decline in oil prices and travel stocks as a growing number of Chinese citizens are under quarantine-like conditions. Continued quarantine could place pressure on global supply chains as factories are temporarily shut down. The respite provided to global industrials from the US-China trade truce has probably been somewhat negated.

The larger question the market faces from the coronavirus is whether it will amount to a seasonal hiccup, cured by warmer weather, or have more lasting implications. Based on the market rebound in early February, it seems to be indicating the former.

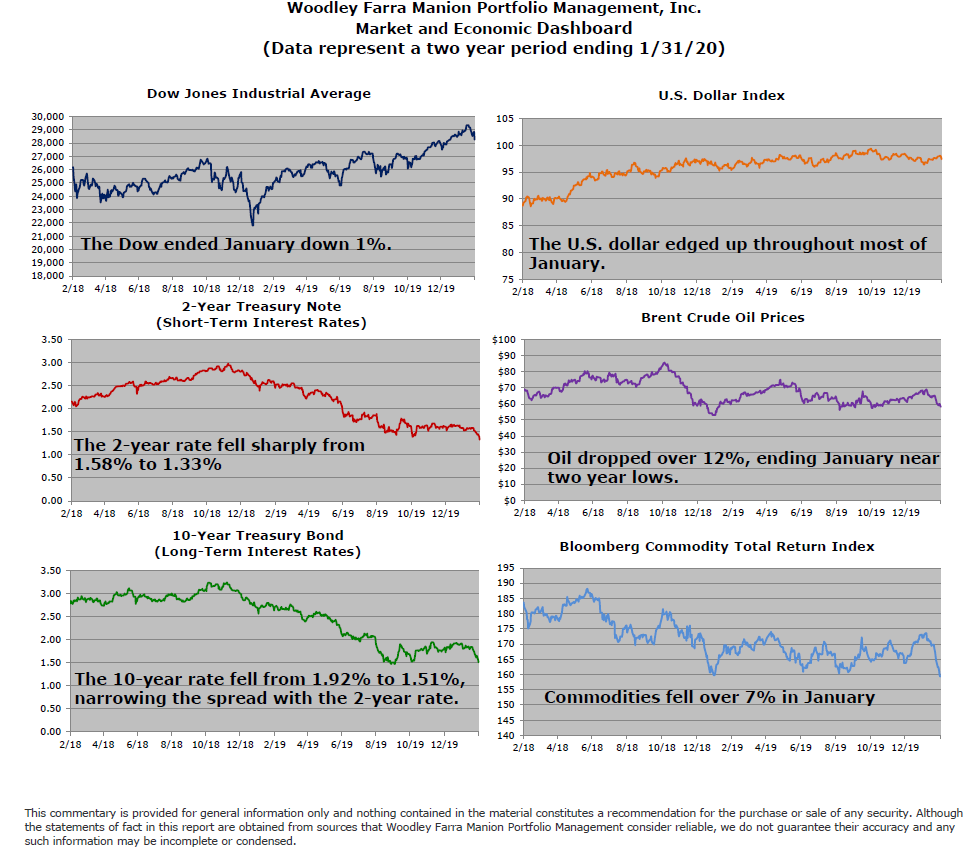

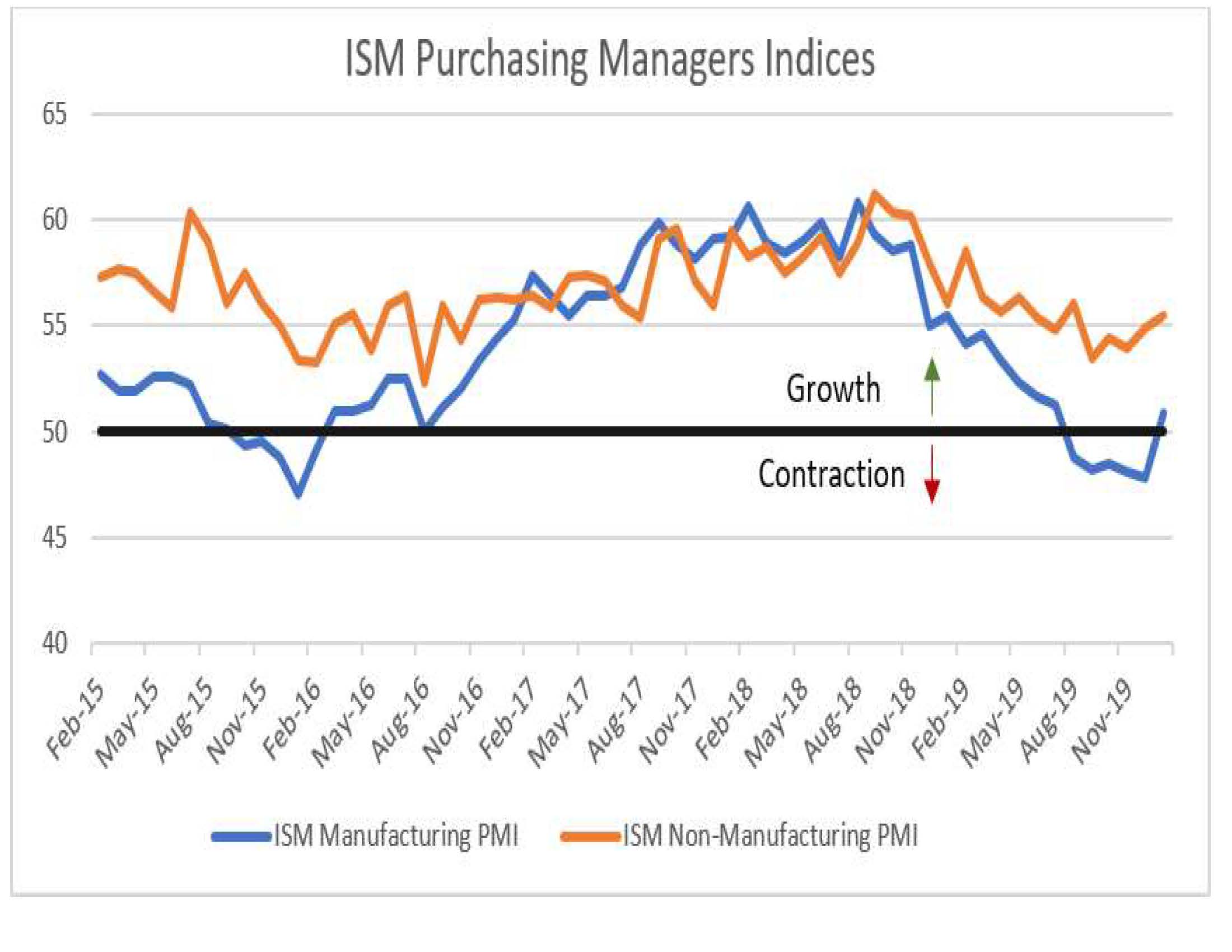

Lost on all the event driven news has been corporate earnings coming in better than previously expected. According to FactSet, 4th quarter 2019 S&P 500 earnings are coming in approximately flat year over year vs. the expectation they would be -2% only a month ago. While flat earnings sound unimpressive, it’s important to note the wide discrepancies in earnings growth between sectors. Utilities, Financials, Healthcare, and Communications Services each have reported over 6% increases in earnings so far. Dragging down earnings are energy, materials, and industrials. Each of these sectors is seeing year over year declines in earnings of at least 10%. This confirms the industrial recession the US economy has been experiencing, while the rest of the economy chugs along. The chart below shows the Institute of Supply Management’s Manufacturing and Non-Manufacturing Purchasing Managers Indices (measures of manufacturing and service sector activity). Values over 50 indicate expansion, under 50 indicates contraction. Notice the resilience of the service economy over the past 5 years (orange line). The January Manufacturing PMI (blue line) also showed signs manufacturing may be turning the corner by jumping back above 50 in January. This positive sign could be sensitive to the coronavirus in the months ahead should the issue escalate. We will be watching closely. Headlines often drive markets in the short run, but for the long-term investor the story is economic and corporate earnings growth. This story remains intact.

-Jared J. Ruxer