“We are a long way from neutral.” This phrase, uttered by Fed Chair Jerome Powell in response to a reporter’s question in early October, knocked the legs out from under the US stock market and triggered a fourth quarter decline in stocks not seen since the Financial Crisis began in 2008. Powell was referring to the likelihood of future interest rate increases by the Fed to head off inflation. A “neutral” rate implies short-term interest rates are the same as the rate of inflation. Few market observers have ever agreed as to what that rate should be at any one moment, since inflation has several different measurements.

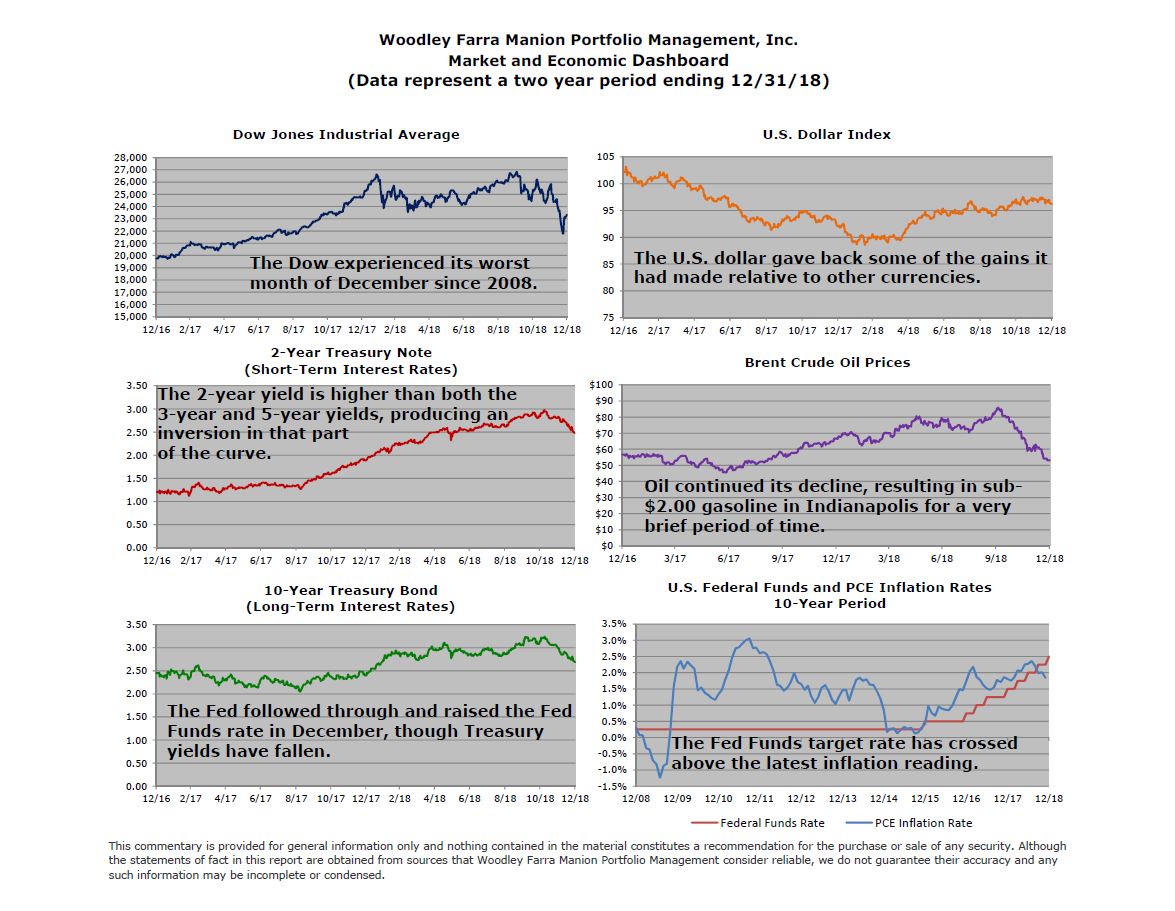

The Fed has had a goal of allowing annual price increases of 2% in the past eight years. However, since Powell’s ascension to the Fed chair position early last year, he has continued his predecessor’s quarterly 0.25 percent rate hike campaign. Will inflation fall short once again in 2019? Will the Fed ignore market signals and keep increasing interest rates? Time will tell.

U.S. interest rates are higher than any other developed country, resulting in a very strong U.S. dollar. A strong dollar hampers other countries’ ability to service dollar-denominated debt and emerging countries’ stock markets have underperformed. France, Britain, Italy and Germany have all faced political uncertainty of late. Recent trade war concerns between the US and China have added an additional layer of insecurity.

If we avoid a recession, this correction/bear market would be considered a non-recession pullback. These have occurred many times over the past 90 years, during a period known as a secular bull market, which is a very long, multi-year uptrend punctuated with short bear markets.

We expect U.S. growth to moderate but remain above post-Financial Crisis levels. Inflation still seems to be well-controlled. Commodities prices are down, especially oil. The only tightness in the economy is in the labor market, but millions of unemployed and under-employed workers are potentially available. Predicting when the market will bottom is impossible, but we are already three months into this downtrend and non-recession bear markets typically last an average of six to seven months. The Fed meets in January and will issue a statement after its meeting. If the tone is temperate and the likelihood of higher short-term interest rates is diminished, the stock market could have a substantial rally.

George S. Farra, CFA