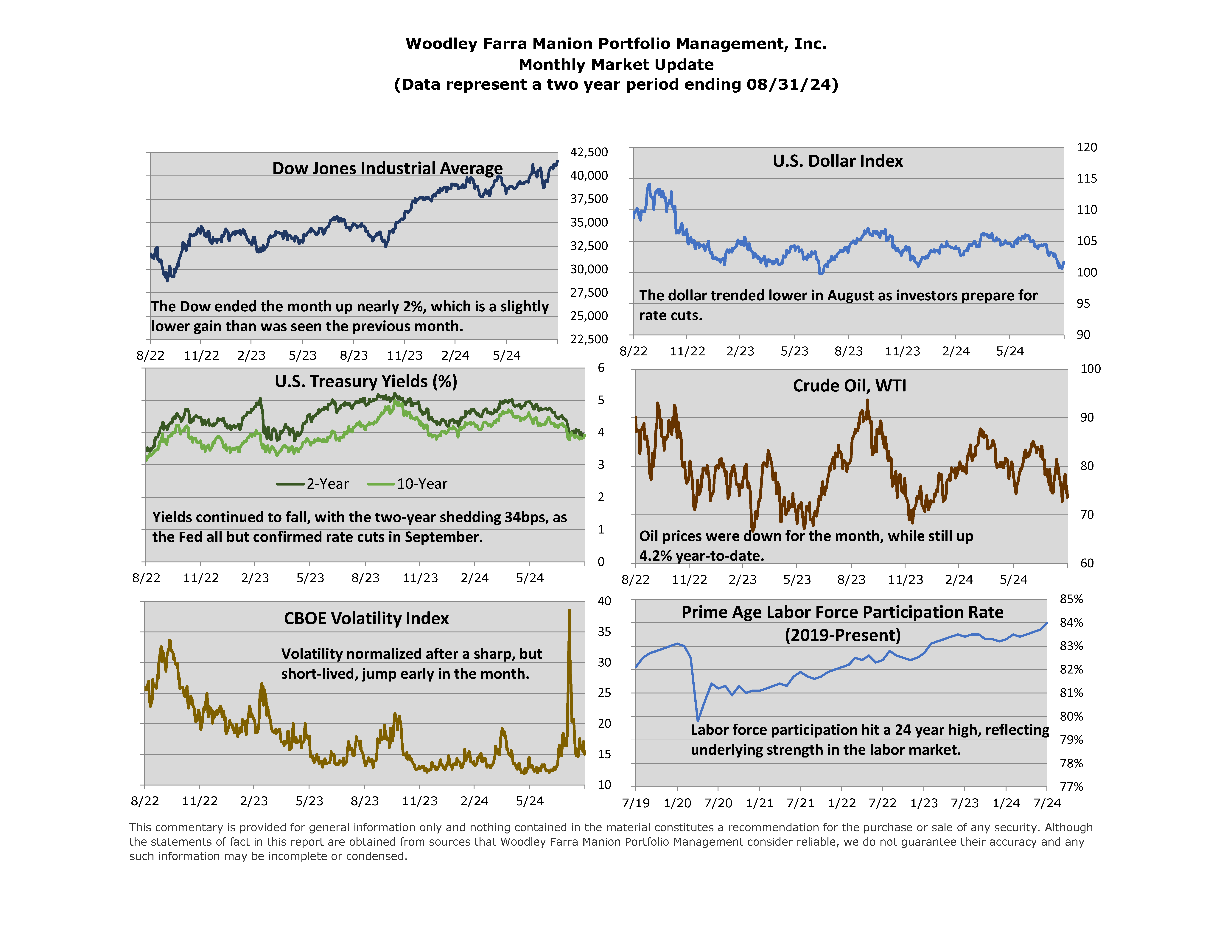

Equity markets began the month of August a bit choppy as investors digested a Bank of Japan rate hike and higher US unemployment data. As a result, a sharp, but brief, drawdown commenced and the CBOE Volatility Index, or fear index, spiked to a high last seen at the onset of the pandemic in 2020 and the Great Financial Crisis before that. As stocks made a quick recovery, bond yields simultaneously fell with investors buying both asset classes. Overall, markets ended up for the month as Fed statements teased incoming rate cuts.

On Friday, August 23rd, Fed Chair Jerome Powell took the stage at the annual economic symposium in Jackson Hole, Wyoming. Anxious investors breathed a sigh of relief when Powell took the stage and stated, “the time has come for policy to adjust,” meaning the Fed is ready to cut interest rates for the first time in four years. He went on to discuss the Fed’s dual mandate of minimizing unemployment and stabilizing prices within the economy and exclaimed that the current unemployment levels are unwelcome.

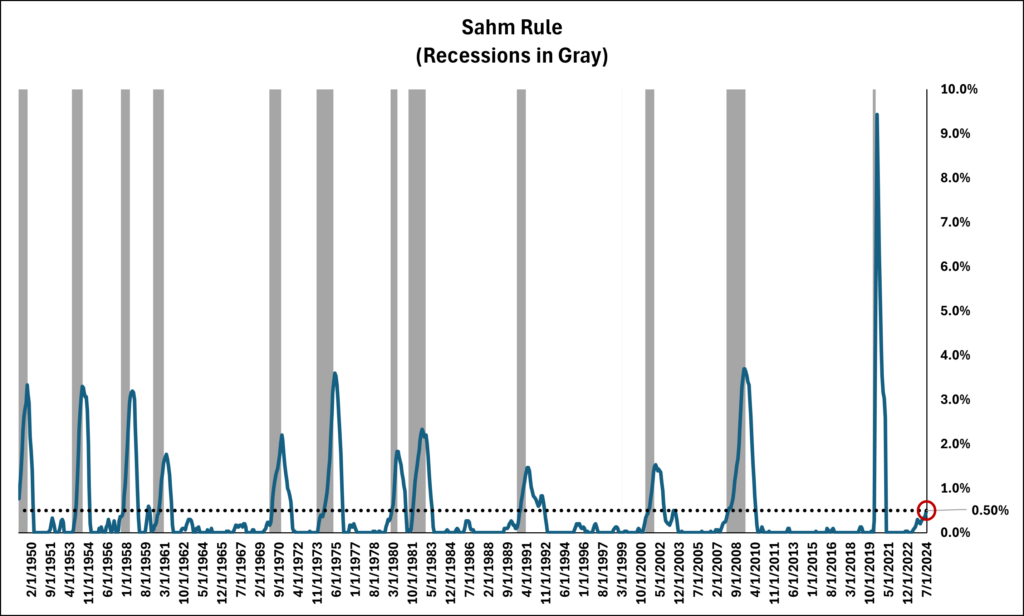

Powell’s statements could not have come at a better time with a popular recession indicator, the Sahm rule, emerging recently. The Sahm rule, created by former Fed economist Claudia Sahm in 2019, indicates a recession is forming when the three-month average unemployment rate is 0.5 percentage points or more above the lowest 12-month reading. Last month’s unemployment reading puts the US right at the 0.5% threshold, which can be seen on the graph below. However, economic indicators are not absolutes. The Sahm rule is just one newly developed signal and may not be predictive going forward. Additionally, the economy is showing some positive signs including a labor force participation rate for prime age workers (ages 25-54) of 84%, almost the highest ever.

Levi I. Gates