August was a more volatile month than usual, triggered by both an escalation of the trade war with China and more indications that the US economy may be slowing more than expected. The S&P 500 had daily changes of over 1% on 11 of the 22 trading days in response to both rhetoric and economic data. In the end, the major averages declined just under 2% for the month, which seemed like a victory given the news cycle. August was also only the second month in 2019 to register a decline, May being the other month to drop.

Interest rates were the more notable story for the month, with the 10-year Treasury declining from 2.02% on July 31st to 1.50% on August 31st. A drop of 25% is a huge move for what is the most liquid security in the world. While stock investors appeared more serene about the outlook for the economy despite all the headwinds, bond investors appeared to be in an outright panic and bought Treasuries with longer maturities (2-years and longer) hand over fist.

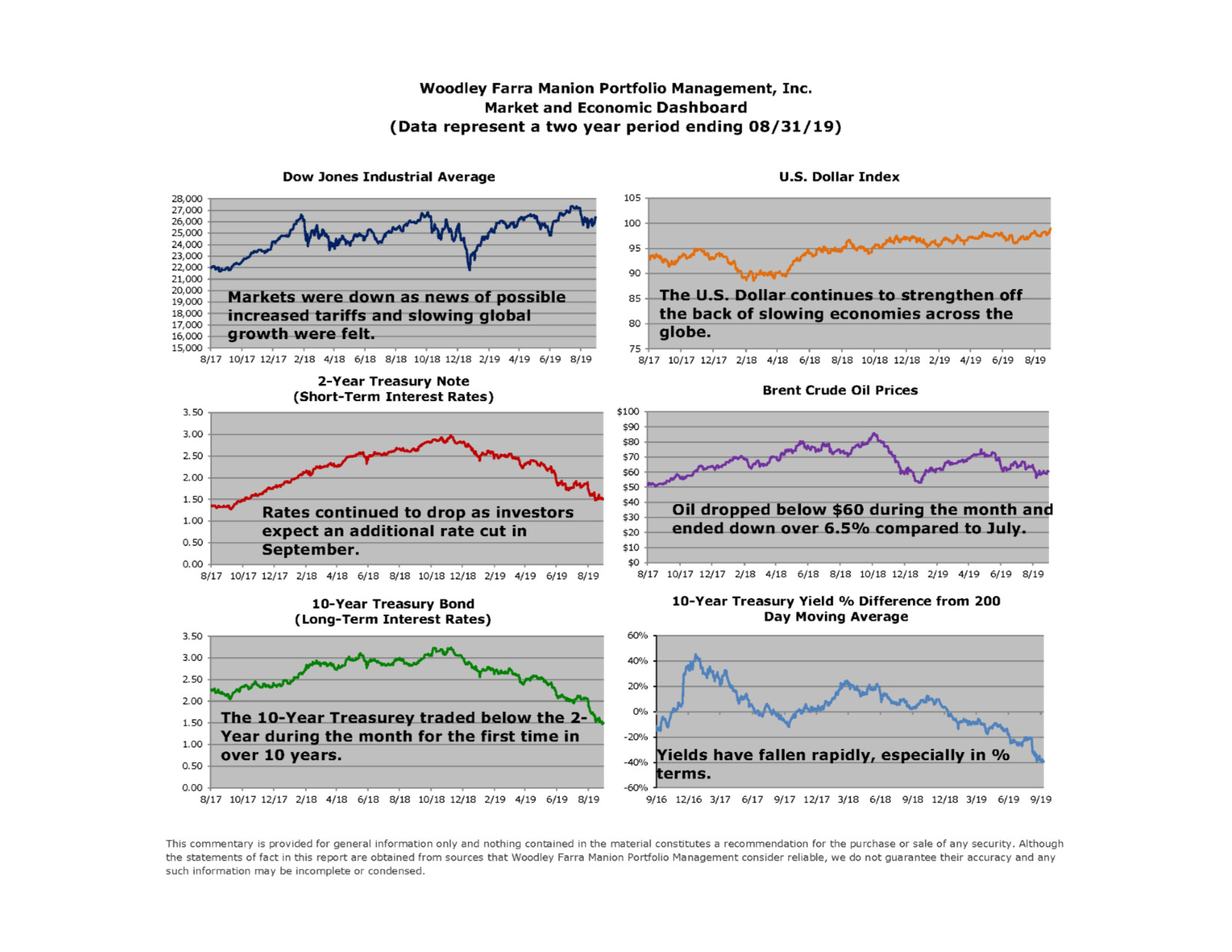

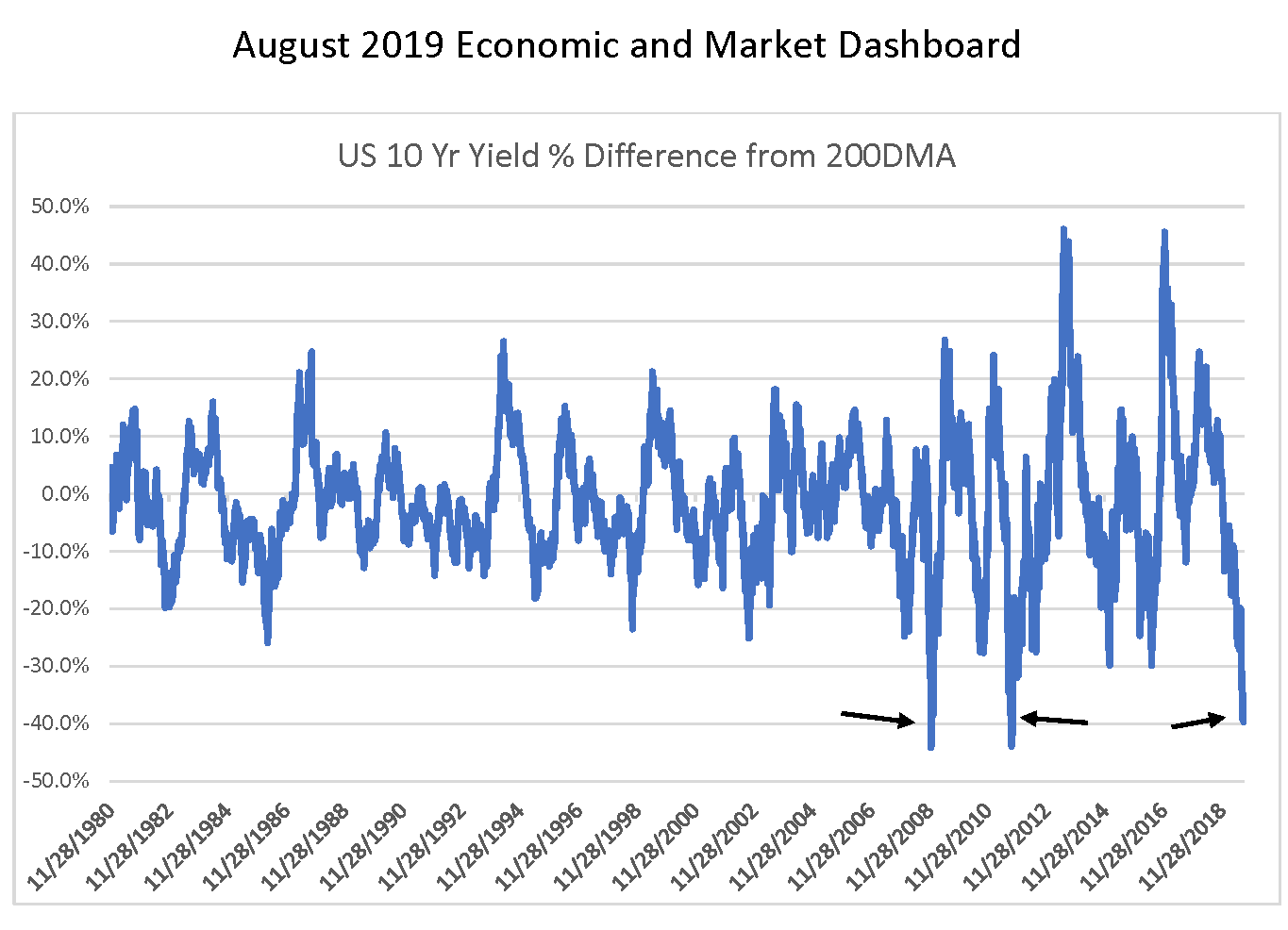

The chart above illustrates how extreme the downward move has been. We measure all securities’ prices relative to different moving averages, notably the 50- and 200-day moving average. These represent the average price of the security over the past 50 and 200 days, respectively. Large deviations from the moving averages may signal investors are expecting a big change in underlying fundamentals.

The chart shows that as of the end of August the 10-year yield was 40% below the 200-day moving average, a level surpassed only at the height of the Financial Crisis in November 2008 and the peak of the Euro Crisis in the fall of 2011. A large deviation may also represent panic buying or selling. And right on cue, news about an October summit between the US and China has driven the Dow higher over 750 points from its low in the first week of September and interest rates higher by almost 0.2%. So once again the markets have abruptly switched from panic to euphoria. Investors who bought a 10-year Treasury paying under 1.50% may rue the decision if this trend of higher rates continues.

Bond investors are often cited as the smarter group compared to stock investors, taking a green eyeshade to good or bad news. Maybe August was an exception to the norm and the economy is in better shape than feared.