North Korea has dominated the headlines lately, with the Labor Day weekend being no exception. At just 33 years old North Korean’s leader Kim Jong-un has proven to be quite unpredictable. Luckily it’s not our job to hypothesize about what actions he’ll take and therefore what military action, if any, should be taken. Our job, however, is to prepare you in regard to how his actions might affect your portfolio. While it’s impossible to predict the emotional toll of any potential confrontation, history does provide some guidance as to the resilience of the stock market.

As our first example, let’s start with the most notable act of terrorism on American soil, September 11, 2001, which resulted in the stock market closing for four straight days. When it opened back up the following Monday the S&P 500 declined over 5% in just one day. While certainly nothing to balk at, that doesn’t even register as one of the 20-largest single-day declines in the index, and was certainly the result of a lot of impulsive selling. What might be surprising is that if you had bought the S&P 500 on September 10, 2001 and held it through the end of the year, you would have had a total return of 5.5%. Not bad considering the market was still reeling from the internet bubble popping.

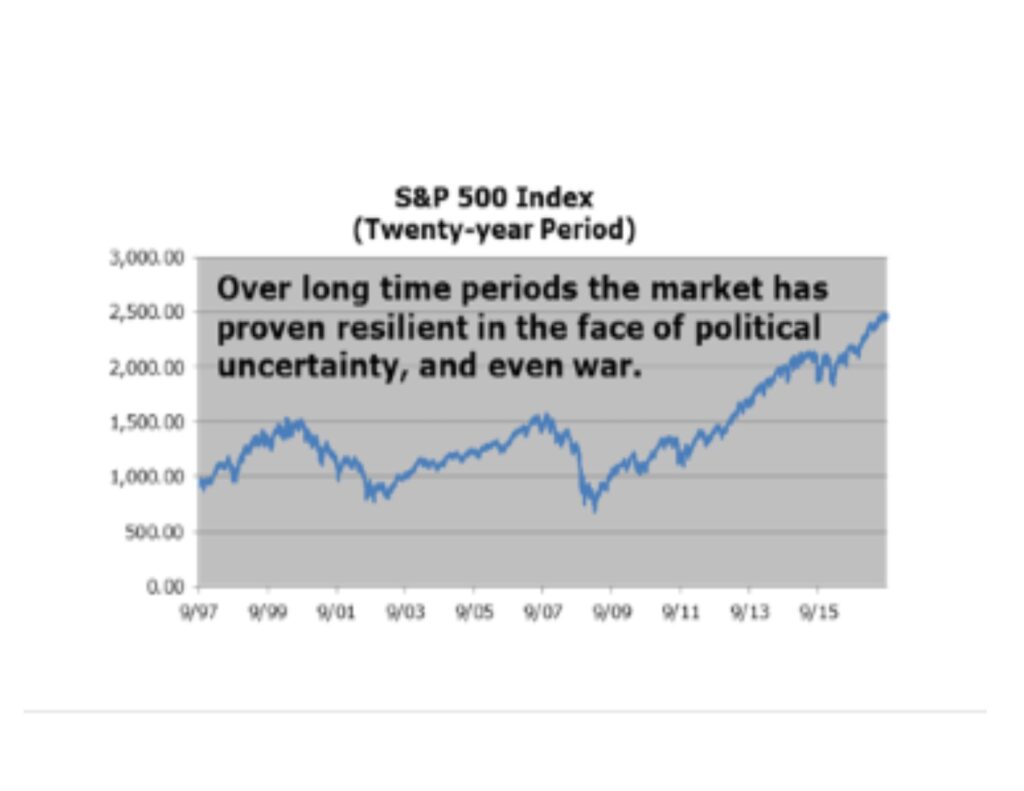

For a prolonged example of what potentially could happen we can look back to the United States’ involvement in World War II. Over the course of the entire war the S&P 500 returned over 5% on an annualized basis, but perhaps what’s more notable is the index’s return from the date of the attack on Pearl Harbor on December 7, 1941 through the end of the war on September 3, 1945. While the initial shock of the country’s entry into the war led to a 20% decline it would take less than two years for the index to recover those losses, ultimately returning over 14% on an annualized basis during that time.

There are countless examples we could run through, and likely some that refute our argument in the short term. What has been irrefutable though, is the long-term resilience of the U.S. stock market. We cannot predict short-term reactions, or long-term reactions for that matter, but we are confident that over the long run this resilience will persist.