April was a relatively calm month for U.S. stocks. The S&P 500 advanced 1.6%, continuing a strong start to the year; the index has now risen 9.2% through April. Nevertheless, gains in the popular U.S. benchmark index have not been broad-based. The S&P 500 is a market-capitalization-weighted stock index of the 500 largest U.S. public companies. The largest 10 companies comprise about one-quarter of the overall index, while the other 490 companies make up the remaining three-quarters. The largest 10 stocks are up over 35% on average this year, while the remaining 490 stocks are up slightly more than 3% on average. More broad-based strength will be needed to continue to push the stock market higher.

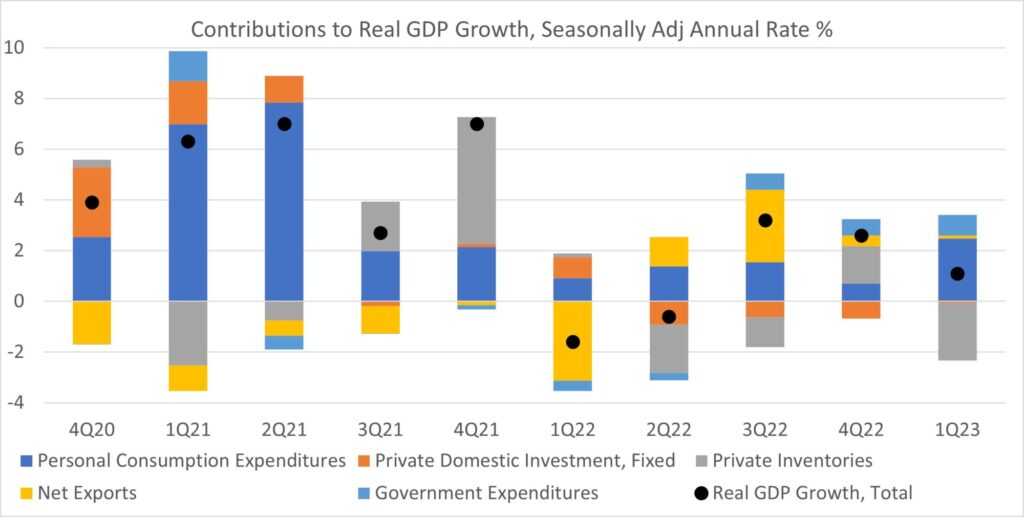

First quarter U.S. GDP grew 1.1% at a seasonally adjusted annual rate. Consumer spending growth has moderated but remained positive. Inventory changes, a volatile component of GDP, were a -2.26% headwind to growth in the quarter (meaning GDP growth was over 3% excluding the decline in inventories). The chart below shows GDP growth (black dots) broken down by contributors. Notice the large effect inventory swings have had on GDP growth (grey), amplified by the pandemic. Businesses drew down inventories early in the pandemic, replenished as the economy reopened, and have gone back to cuts in the past year as consumers shifted spending toward services and away from goods. Goods inflation is virtually nonexistent today based on CPI data, a far cry from the mid-teens percentage increases of early 2022. Services inflation has remained stubbornly elevated.

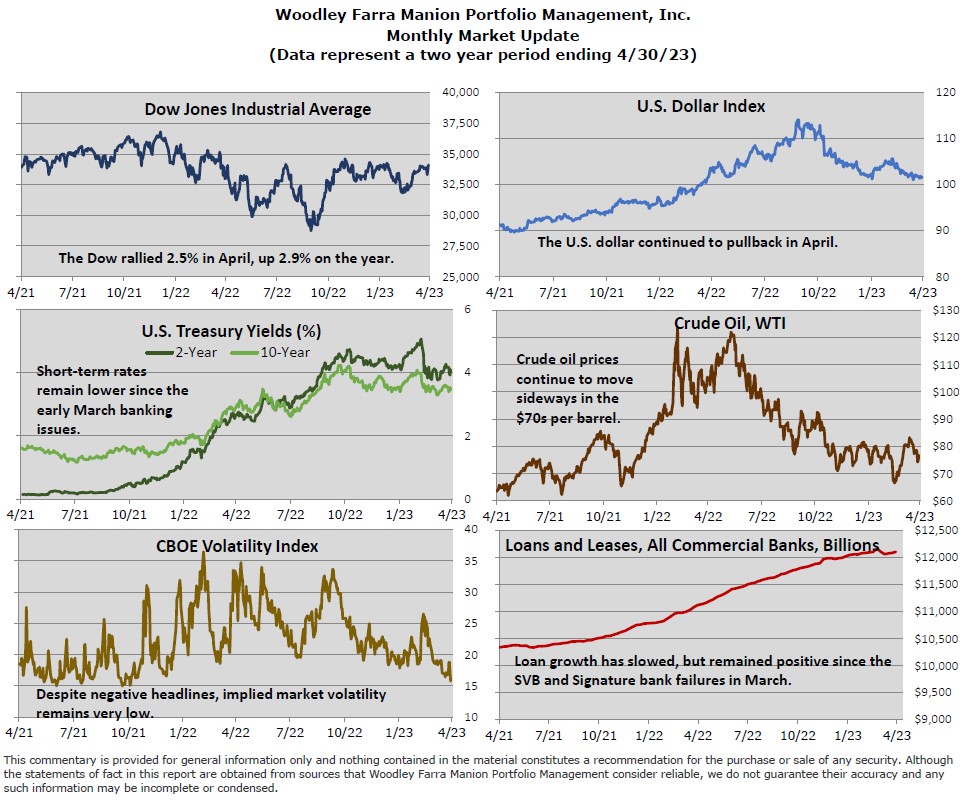

First Republic Bank was placed in FDIC receivership and purchased by J.P. Morgan Chase at the end of April. The bank struggled to survive after the initial SVB and Signature Bank collapses in March, finally succumbing to a continuous flight in deposits. Investors and the Federal Reserve continue to eye the knock-on economic effects of recent banking events. The primary concern is that banks will tighten credit standards and reduce lending, resulting in reduced consumer spending and business investment. Thus far, Federal Reserve data shows a slowdown in lending, but not a contraction.

-Jared J. Ruxer, CFA, MS