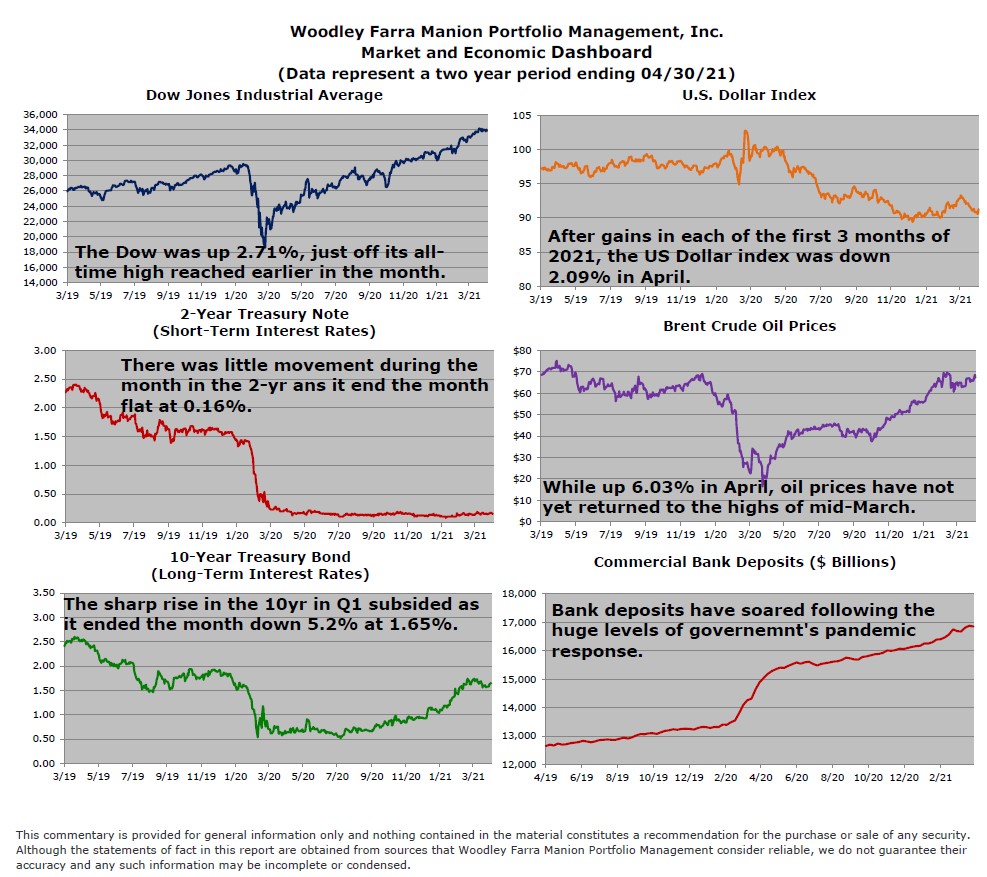

The S&P 500 advanced 5% in April as treasury yields stabilized following a significant run-up in the first quarter. First quarter GDP results were released at the end of April, showing 6.4% real growth and 10.7% nominal growth, annualized. Retail sales and goods consumption soared in March as more stimulus boosted personal incomes. The wave of consumption has further stretched COVID-impacted supply chains and inventories. In response to tight supply and robust demand prices have moved higher – particularly for industrial & construction commodities. Copper, lumber, steel, and aluminum prices are all much higher than before the pandemic. As commodity producers, manufacturers, and retailers scramble to meet demand, they have ramped up hiring and job postings. March employment rose over 900,000, marking the best month for job gains since August. Job openings now exceed pre-COVID levels, as employers attempt to entice individuals into returning to the labor force.

As inflation has presented itself in recent months, the ongoing debate at the Federal Reserve and among market participants is if the inflation is “transitory” or will be longer lasting. The transitory camp, which includes Fed Chairman Jay Powell, contends that pandemic-created supply chain bottlenecks will resolve as the economy fully reopens, with longer-term inflation expectations being the key focus. If inflation proves to be not-so-transitory the Fed has tools (higher interest rates, tapering asset purchases) to combat it, though the market may not like them.

The breakeven inflation rate is a market-derived implied inflation rate from the spread in yields on inflation indexed treasuries (TIPS) and fixed treasuries. The breakeven rate is the market’s expectation of future inflation – though it has not always been a great predictor of actual inflation. Interestingly, the market is currently signaling slightly higher near-term inflation, as noted in the chart below. Wages play a pivotal role in inflation, making them a key indicator to follow as the labor market recovers and the Fed closely eyes inflation. The market’s concerns about inflation are likely to remain for some time.

-Jared J. Ruxer, MS