Consumers have long been sensitive to changes in prices they pay for everyday goods and services. The double-digit inflation of the 1970s and early 1980s has long given way to the more predictable 2% annual gains we have experienced for the past 25 years. The severe recession that followed the Financial Crisis of 2008 actually lead to fears the US economy would experience deflation, the outright drop in prices paid, which then drove the Federal Reserve to begin applying unconventional monetary policies like zero percent interest rates and buying trillions of dollars of US Treasuries and other government agency obligations. The Fed’s goal was to avoid deflation and boost the prospects for a return to more normal annual price increases of 2% or more.

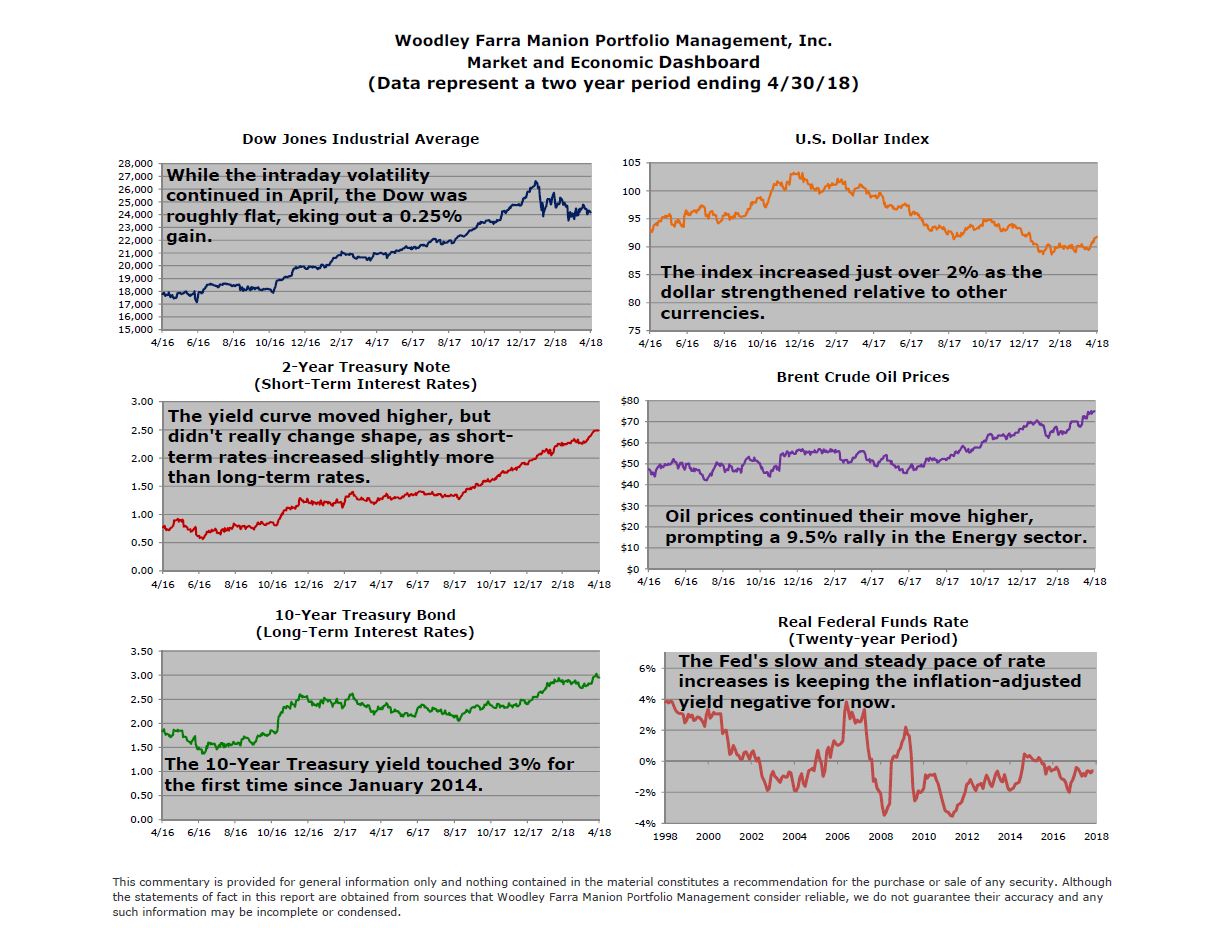

Using what is now a hackneyed cliché, the Fed can claim “Mission Accomplished!” After dipping below 2% for most of 2017, the Consumer Price Index has breached 2% and is trending somewhat higher. Now the Fed’s job is shifting to controlling inflation by continuing to raise short-term to more “normal” levels. The Federal Funds rate has been raised six times since 2015, from zero to 1.50%. Note that this rate is below the CPI rate of 2%, meaning the “real” or after-inflation interest rate is -0.61%. The Fed will continue to increase the Fed Funds rate until it is at least equal to inflation (2%) or higher. We expect the Fed to continue to hike the Fed Funds rate well past 2%; investors anticipate three more rate hikes in 2018 and four in 2019. If each hike is 0.25%, we could see the Fed Funds rate at 3% or more by the end of 2019.

Now, those of us “seasoned” veterans of the late 1970s and early 1980s remember the Prime Rate charged by banks to their best customers was 21%, so a 3% target is not so bad! And a return to more normal monetary policy confirms the hangover from the Financial Crisis is coming to an end. We all heard about the “New Normal” of slow growth and malaise during the height of the crisis. It’s good to be getting back to the Old Normal.