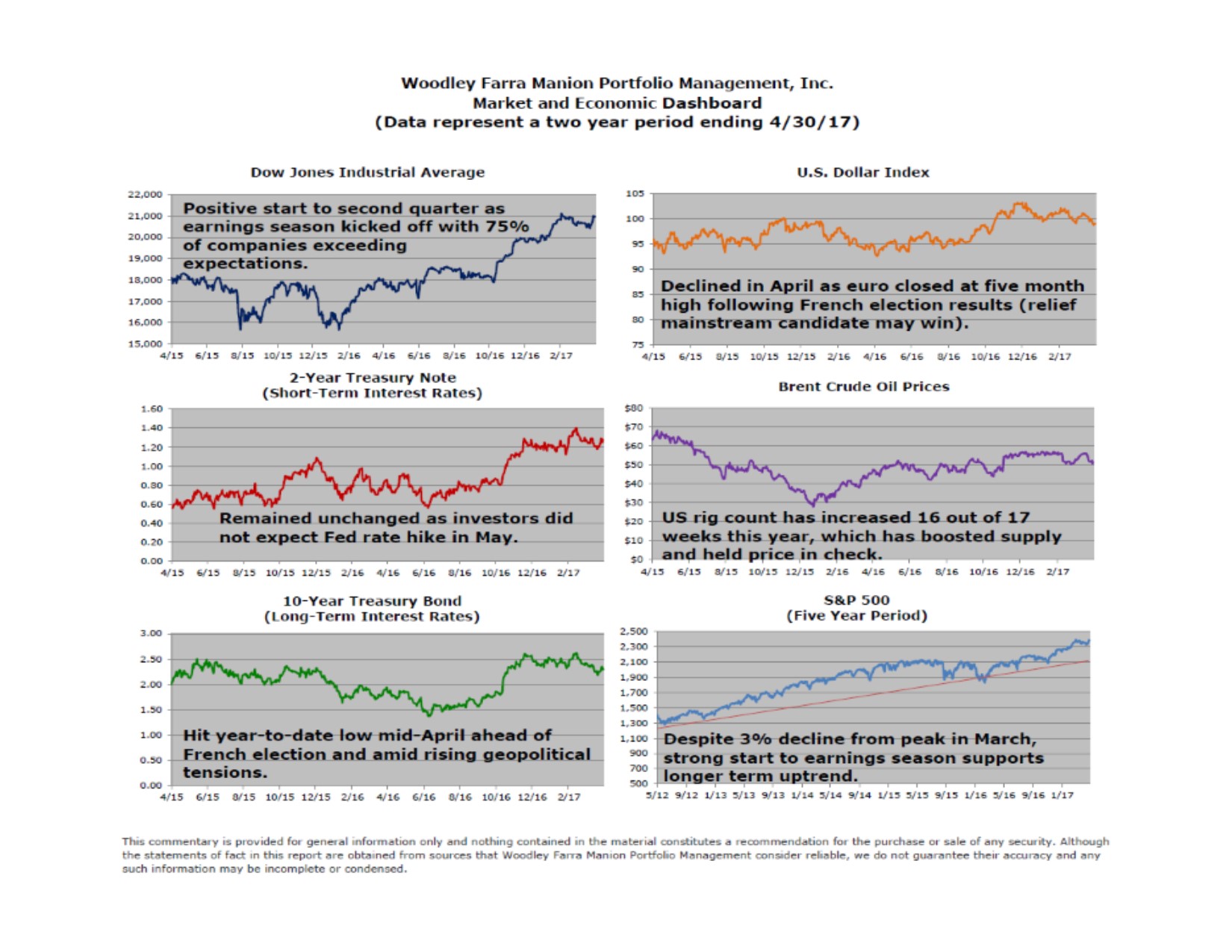

Spring is officially here and it apparently brought the post-election market rally to a halt. On March 1st the S&P 500 hit an all-time high of 2,401, an 11% increase from Election Day. Since then the rally has stalled, having declined about 3% before recovering and finishing April within 20 points of the high. Much of the rally could be attributed to expectations for higher corporate profits as a result of business-friendly policies the new administration was going to initiate: cheaper healthcare, lower taxes, decreased regulation, etc. It also didn’t hurt that consumer confidence hit a 17-year high and the unemployment rate remained below 5%.

So why the pause? The new administration’s first 100 days have come and gone and a failed healthcare bill has shifted the investor mindset from “when these policy changes occur” to “if these policy changes occur.” Investors now appear more cautious about a successful tax-system overhaul and are questioning what that means for corporate profits going forward. But absent any policy changes, if quarterly earnings continue to improve, as they have, then the post-election rally will be justified not because of expectations, but because of existing underlying strength.

In fact, by the end of April over half of companies in the S&P 500 had reported earnings for the first quarter, with 75% beating analysts’ expectations, which is well above the four-year average of 68%. According to FactSet, earnings are expected to grow 12.5%, which would represent the first double digit increase since Q4 2011. What corporate America is exhibiting is not a dependency on a dramatic shift in fiscal policy, but a resurgence in consumer confidence partly due to improving wage growth and cheaper gasoline prices. As CEOs discuss first quarter earnings they don’t see healthcare and tax reform as a requirement for continued success, but rather an additional bonus that they would certainly welcome.

At the end of February we said we wouldn’t be surprised to see a 3-5% pullback, and while March gave us that, the early results from earnings season have also reaffirmed our longer-term outlook that in spite of any fiscal policy changes the underlying fundamentals are still strong and the trend is still higher.